You are currently browsing the tag archive for the ‘Howard ‘Halifax’ Brown’ tag.

More news emerged over the weekend about the state of British banking.

Normally, when Parliament is in recess, there is little news to cover. Traditionally, Britons call this period the ‘silly season’ in the media, full of non-stories.

However, as in 2022, when the Conservative Party leadership race dominated, this summer’s big story is real and gripping: bank account closures.

Even The Guardian is reporting on it regularly, despite Labour’s near radio silence, apart from shadow chancellor Rachel Reeves who implied that sacking Dame Alison Rose was tantamount to sexism because she was the first woman at the head of a large financial institution. So what? Rose was wrong; if she were a mere cashier (teller), she would have been sacked for gross misconduct for violating client confidentiality. On the other hand, Lloyd-Russell Moyle MP said he would support Farage in his quest for fairer rules on account closures.

Farage winning

Clearly, Nigel Farage is winning the battle against NatWest and its subsidiary Coutts, his former bank.

At the end of last week, Farage vowed to start a website dedicated to account closures, more about which below.

Last Friday, July 28, 2023, The Guardian reported (emphases mine):

Nigel Farage is used to being thanked by true believers in Brexit, but the man who came to grasp his hand as he sat down for dinner in London’s Belgravia on Tuesday night was a surprise.

“It was a chap who just said ‘Nigel, I’m a remainer, but please, stand up for us’. He was an Italian businessman in London who was having terrible trouble receiving foreign payments because banks thought he was a money launderer,” the former Ukip leader said.

Hours later, the departure of Dame Alison Rose as NatWest’s chief executive over her role in the Farage “debanking” controversy would give the politician turned broadcaster one of his greatest coups since Brexit.

It has also lifted him from the relative obscurity of his last reinvention, as the star anchor of GB News. Just like old times – when he was a near-omnipresent fixture across all channels – he has suddenly found himself back in the limelight with a soapbox issue that has ministers and the rightwing press following in his wake.

He is now launching a website to collect details of tens of thousands of people he expects will back his campaign against a banking system he claims is “rotten to the core”. While he says it will be “non-political, non-party”, the future political potential of such a database is obvious …

His latest campaign, launched on 30 June in a tweeted video that claimed his accounts with a “prestigious” bank had been closed without explanation, was different. The details were sparingly teased out in tweets and videos before NatWest-owned Coutts was confirmed as the bank in question.

By the time Farage revealed, via a subject access request, that Coutts had compiled a secret 40-page dossier accusing him of being a “disingenuous grifter” who promoted “xenophobic, chauvinistic and racist views”, it had turned into a monumental PR disaster for the bank.

Lloyd Russell-Moyle, a Labour MP who went on Farage’s GB News show on Wednesday night to talk about his own banking struggles as a “politically exposed person”, said: “He has tapped into something here which I think the liberal elite in my own party and in the media have misunderstood, and that is how the banks have treated some people appallingly and how they continue to operate.

“What Farage has done this time is take something that is a privileged, niche problem for him and then really build on it in terms of how the public are treated. It’s effective politics.”

Yet while Russell-Moyle does not view Farage’s banking campaign as a “culture war” issue, close watchers of Farage and various incarnations of Britain’s populist right and far right remain wary.

Joe Mulhall, the director of research at the anti-racism campaign group Hope Not Hate, said Farage had clearly been “looking round” since Brexit for a new issue, adding: “He hasn’t been this relevant for years.”

He added: “For a period he was the keeper of the Brexit flame but … its salience has dissipated so he has been looking for an alternative and seems to have found one that paradoxically makes him a crusader for the ‘working man’ and small businesses wronged by an elite.”

That may be, but Farage has been telling us about his full inbox for weeks now, so he has struck a genuine chord with the British public.

It surprises me that Hope Not Hate would shy away from joining Farage’s campaign in principle. Enough said about them.

Early on Sunday, July 30, the paper reported on the imminent website, which appeared shortly afterwards, and on how unpopular NatWest’s chairman Sir Howard Davies is among Conservative MPs:

The former Ukip leader is to spearhead a website assisting anyone who wants to find out why they have been denied a bank account. Farage used a subject access request to discover that, despite initial denials by Coutts, his political views had played a part in the closure of his account.

Farage is said to want to make the independent website a non-partisan tool designed to help those who believe they have been denied banking services because of their political views. It will provide them with a step-by-step guide to demanding the personal information a bank holds about them.

While NatWest, which owns Coutts, is said to have faced hundreds rather than thousands, of similar requests so far, Farage and his supporters believe the new website will help those daunted by the process of questioning their bank.

“This is cross-party, it is non-partisan,” said an ally. “Dare I say, how the liberal elite – for want of a better term – have managed to turn Nigel Farage into one of the country’s leading consumer champions, I have no idea.”

There has already been a huge fallout from Farage’s case. Dame Alison Rose, the chief executive of NatWest Group, eventually stood down in the wake of the row after she revealed she had been the source of a BBC story claiming Farage’s account had been closed for commercial reasons.

She was soon followed out of the door by Peter Flavel, chief executive of Coutts. Farage also wants NatWest Group’s chairman, Howard Davies, to stand aside.

While Downing Street made clear that Rose could not stay in her post, the government appears to be more protective of Davies. Andrew Griffith, the City minister, said on Friday night that it would not be “helpful” for the NatWest Group’s chairman to quit.

However, Davies is already unpopular with some on the Tory right. He unleashed a stinging criticism of Liz Truss and Kwasi Kwarteng’s disastrous mini-budget in front of hundreds of his staff last year. He explained how he felt “embarrassed” in its aftermath while attending a conference for the International Monetary Fund, the Washington-based lender of last resort.

Farage’s new website is AccountClosed.org, at the bottom of which says:

… Account Closed, a campaign group for individuals and small medium businesses who have been unfairly treated by bank and financial services companies.

The website has a short survey about whether one agrees with current banking practices concerning account closures. Entering one’s email is optional at the bottom of the home page.

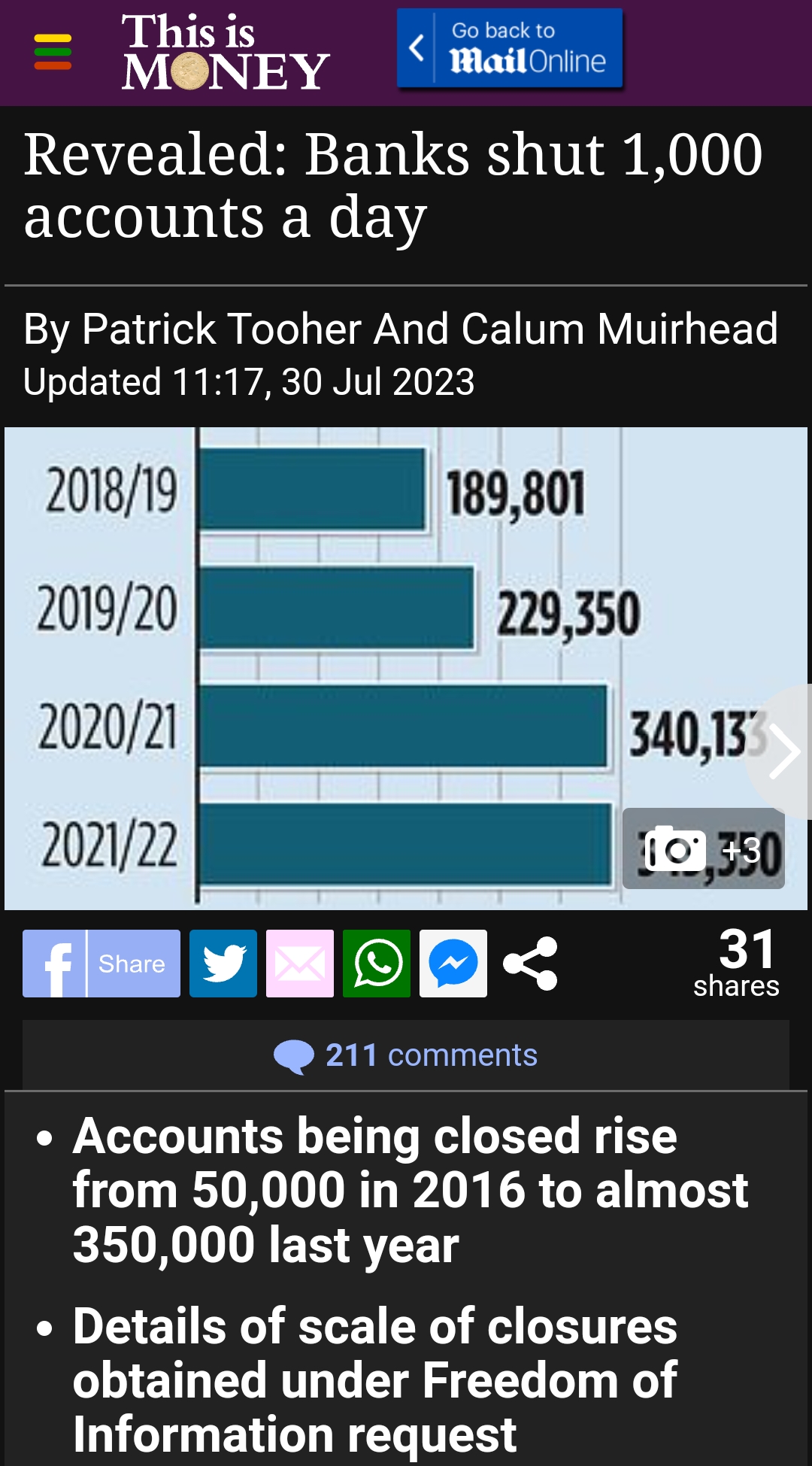

This is a huge issue, as over 1,000 British bank accounts are closed every day. Farage rightly says that this is ruining the lives of many, especially small businessmen and women. The shocking statistic was a headline not only at GB News but also The Mail and The Guardian:

On Sunday evening, GB News’s Mark Dolan interviewed Howard Brown, who was the face of the Halifax for several years in television adverts. He had customer-facing and marketing jobs with the bank. He said he was astounded to hear of account closures en masse and said it never occurred when he was in banking. He said the situation is ‘saddening’:

On Monday evening, July 31, Farage opened his GB News show by mentioning the website and had an update on his closed Coutts account:

The Guardian reported that, in his editorial, he said, in part:

Nigel Farage has said that the newly installed boss of Coutts has offered to keep his accounts there open, reversing a decision that triggered a scandal and the resignation of the private bank’s previous chief executive.

The former Ukip leader said he welcomed the offer but was still taking legal action against NatWest, which owns Coutts, demanding compensation, a full apology and a face-to-face meeting with the banking group’s bosses.

Peter Flavel resigned as Coutts chief executive last Thursday, less than two days after the NatWest boss, Alison Rose, also stepped down over her role in the row. Flavel has been replaced by Mohammed Syed.

“The new CEO of Coutts … has written to me to say I can keep both my personal and my business accounts, and that’s good, and I thank him for it,” Farage said on GB News on Monday night.

“But enormous harm has been done to me over the course of the last few months … It has taken up a huge amount of my time and it has cost me, so far, quite a lot of money in legal fees. So I have today sent a legal litigation letter to Coutts, where I want some full apologies, I want some compensation for my cost.

“But more important than all of that, I want a face-to-face meeting with the bank’s bosses. I want to find out how many other people in Coutts or NatWest have had accounts closed because of their political opinions. And I want to make sure this never happens to anybody else ever again” …

Farage did not clarify whether he had accepted Coutts’s offer to keep his account open. NatWest Group said it could not comment on individual customers.

Good!

The article continues:

His comments came hours after the City regulator urged NatWest shareholders, including the UK government, to “choose stability”, suggesting they should resist calls for the group’s chair, Howard Davies, to resign over the ballooning scandal linked to Farage’s accounts …

Farage wants more heads to roll at NatWest – which is still 38.5% government-owned after its 2008 state bailout – but on Monday the Financial Conduct Authority (FCA) called for calm.

“The economic secretary to the Treasury [Andrew Griffith] just last week mentioned that he had confidence in Howard Davies, the current chair,” the FCA’s director for consumer matters and competition, Sheldon Mills, said. “I agree with his view that it’s important to have stability at NatWest and that having a chair remain in place will help support that.”

Later, on Dan Wootton’s GB News show, Farage said that Travers Smith, the law firm conducting the review of Farage’s account closures as well as those of others over the past 24 months, had spoken out against Brexit some years ago:

Wootton’s opening editorial was about the bank account closures and Farage’s new website. Afterwards, a panel discussion took place with journalist Carole Malone, Boris’s father Stanley Johnson and Conservative MP Dame Andrea Jenkyns. Jenkyns repeated what she had said the previous Thursday on the show: that her bank account had been closed and she has had problems opening another one. Before that and the editorial (around the 11:00 minute mark), the last news item was about a group of Conservative MPs, one of whom is Iain Duncan Smith, who wrote to the Financial Conduct Authority (FCA) to say that action must be taken against banks closing accounts where customer perspectives do not agree with the banks’:

On Tuesday evening, August 1, Farage interviewed mega multi-millionaire Arron Banks, who was co-founder of the Leave.EU campaign prior to the June 2016 Brexit referendum. He was also a major donor to UKIP and, before that, to the Conservative Party. He owns several businesses in the UK. He had been accused of having close ties to Russia. The story grew and grew. A Guardian journalist published accusations with no concrete evidence; a lawsuit concluded only recently, and she has to pay him damages for defamation.

Because of all this, he had his business bank accounts closed, which he said was a period he said was devastating personally and professionally. Farage asked him why he did not speak out. Banks explained that any businessperson who does will find themselves blacklisted with other financial institutions. A parlous state of affairs:

Bank account closures: what to do

On Monday, August 1, The Telegraph posted ‘Are you at risk of having your bank account closed?’

The article gives the reasons why banks may decide to close accounts. Excerpts follow:

If you are related to, or associated with, a politician or high-profile person there is a fair chance banks will be investigating you, and may decide to close your account.

… you can have your account closed if the bank thinks you are a reputational risk and have differing opinions to its values – which Mr Farage claims were the reasons for Coutts closed his account.

… members of the public who know or associate with high-profile people can also find themselves de-banked, even if they aren’t in the public eye.

This is because banks and other financial institutions are required to apply enhanced due diligence to politically exposed individuals – and people associated with them – to ensure that they are not using their institution for money laundering or accepting cash from illegal sources.

The Financial Conduct Authority (FCA) is currently reviewing the rules for politically exposed people, and is set to report back on any changes later this year.

If you have moved to the UK from another country and regularly receive money from abroad – be it from friends or family, or a business – banks may decide to freeze or close your account.

The same could happen if you consistently send large sums of money to overseas accounts …

Banks can be very cautious when dealing with cryptocurrency which, according to recent FCA data, is becoming increasingly popular with younger people.

Cryptocurrencies are unregulated, and as many of the companies that offer this form of currency are based outside of the UK, moving crypto through your account could raise red flags at your bank.

Surprisingly, the same thing can happen when it comes to gambling. There have been claims people have had their accounts shut after receiving deposits of their winnings.

There may be instances where customers are asked to bank elsewhere if their accounts simply are barely used.

Banks have measures in place for converting bank accounts into dormant accounts when they are unused and unable to contact customers for a certain period of time …

Customers should feel empowered to make complaints to their bank when they are unhappy with their service, as long as communications are respectful. Some banks can close an account if a customer is abusive to its staff, either over the phone or in a branch.

While serious issues such as suspected criminal activity should result in the closure of an account, the Treasury and FCA announced they are working on rules to stop bank account closures from happening as frequently …

However, banks are private institutions and, even with the rule changes, can still close a person’s account for various reasons stated above. If the new legislation comes into force, they’ll just have to give you three months’ notice.

I would clarify that last paragraph by saying that the Government — taxpayer, really — still owns 39% of NatWest after the banking crash of 2008. As such, the banking group is not entirely a private institution.

The Telegraph has a helpful article on filing a subject access request — SAR — with one’s bank in the case of frozen or closed accounts: ‘Find out what your bank thinks about you’:

Under the General Data Protection Regulation 2018, everyone has the right to ask an organisation, including a bank, whether or not they are using or storing their personal information.

You can also ask them for copies of your personal information, verbally over the phone or in branch or in writing, through a “right of access” – otherwise known as a SAR.

You can make a SAR request if you want to find out more about what personal information a bank holds about you, how they are using it, who they are sharing it with, and where they got your data from.

A notice on NatWest’s website states that you should be specific in your submission regarding the information you want to obtain from the bank.

This includes whether you want or need a certain call recording with the bank or a copy of a document.

Essentially, the more information you provide in your SAR the easier it will be for your bank to find it in its system and reply promptly.

If you and a joint account holder want to see the information held in that account, both parties should complete and sign a SAR form. One copy of the information held on the account will be issued for the attention of both parties.

After a SAR is submitted your bank will typically respond to your request within 30 days, but more complex requests can take up to 90 days.

A bank will send your information back in PDF form to a verified online bank account, email or via post to a confirmed address.

Disagreement about Sir Howard Davies

Not everyone is so enamoured of NatWest chairman Sir Howard Davies or keen to see him stay on.

On Friday, July 28, The Telegraph‘s chief City commentator Ben Marlow put forward the case against him in ‘NatWest can’t move on with Sir Howard Davies in charge’:

… After the tsunami of criticism that has engulfed the company and the resulting vacuum it has left at the top, some level of reassurance and calm was probably needed. But a “business as usual” approach from those that remain in the boardroom also speaks to the problems at the heart of the organisation.

Interim chief Paul Thwaite says he is “determined we…start to move forward quickly” but the idea that NatWest can do that with Sir Howard still overseeing affairs is desperately naive and suggests the penny still hasn’t dropped at NatWest HQ. Sir Howard has “reflected” on his position and decided – shock horror – that he shouldn’t have to go too.

He should do the honourable thing and step aside now. Having almost fulfilled his full nine-year term anyway and with a search already underway for a successor, what’s the point in hanging around?

Sir Howard says it’s about ensuring stability but I would argue it does the opposite by prolonging the uncertainty and making it impossible to draw a line under the crisis. And what message does it send about how serious the bank is about overhauling its rotten culture, which is what now has to happen?

Sir Howard has already proven that he’s the wrong person to lead any sort of post-mortem into this catastrophic act of self-harm with the risible way in which the board responded throughout, or rather didn’t – at least initially.

Marlow brought a new person into the mix, Lord Remnant, who is the chairman of Coutts:

The 72 year-old [Davies] and his Coutts counterpart Lord Remnant are esteemed City grandees with vast experience of operating at the very highest level of the financial sector.

Sir Howard has worked at the Treasury, been the deputy governor of the Bank of England, and has previously led the predecessor to the Financial Conduct Authority. Remnant was a senior investment banker at Credit Suisse, has been director of the Takeover Panel on two occasions, and was on the board of Northern Rock [which went bust in the 2008 UK banking crash], though a cynic might point to the existence of one or two sizeable red flags in that CV.

Yet, in the face of what is the biggest crisis the bank has faced since the financial crash, the pair have been conspicuous almost entirely by their silence.

Sir Howard kept his head down only until it was obvious that he couldn’t any longer. Yet when his intervention came, he fluffed his lines spectacularly by allowing Rose to issue a nonsensical apology and stay in post.

As the saying goes: “you had one job”. Hours later she was gone – the result of a humiliating dead-of-night intervention by the twin forces of Number Ten and the Treasury no less.

Meanwhile, there hasn’t been a peep from Remnant despite the departure of Flavel 24 hours later. Governance doesn’t come much more meek than this.

Perhaps Sir Howard is hoping that a giant shareholder bung in the form of £500m of dividends and a £500m buyback, £190m of which will go to His Majesty’s government as the bank’s largest shareholder, will buy him some time.

One assumes he has the backing of ministers for now at least but the idea he can hang around until next year, as planned, is plainly nonsense. At the very least, his exit will surely be accelerated by six months …

I hope so.

Lord Remnant

Not having heard of him, I had to look up Lord Remnant.

Philip John Remnant, 68, is the 4th Baron Remnant and a hereditary peer. In a July 2022 House of Lords by-election for hereditary peers, he was elected to replace Lord Brabazon of Tara after his retirement in April that year. Both are Conservatives.

Last Thursday, July 27, The Mail told us much more, although they left out his time at Northern Rock:

Tory peer Lord Remnant took over as Coutts chairman in January after a string of roles in finance and business.

The ‘lifelong Conservative’ was voted into the House of Lords last July, having promised in his candidate statement to ‘commit enthusiastically to the Lords’ after ‘reducing business interests’.

A few months later he was appointed Chairman of Coutts, with NatWest chairman Sir Howard Davies announcing him as an ‘excellent addition’ who would ‘add immense value to guide and inform Coutts business priorities going forward.’

In a speech on the Trophy Hunting bill, Lord Remnant described his ‘natural habitat’ as the ‘financial services jungle’.

He had recently stepped down from water company Severn Trent plc after nine years on the board and retired from the Takeover Panel after 10 years as deputy chair.

Previously, he was Chairman of the City of London Investment Trust plc and of M&G Group Limited.

In his maiden speech in the Lords he said: ‘I followed my father into the City, as a chartered accountant and then an investment banker.

‘Since then, I have sat on the boards of major listed financial services companies and so have long been subject to the rules of our financial regulators.’

Born in 1954, with two brothers and a sister, he attended Saint Ronan’s School in Hawkshurst, Kent – the same school as his father, the previous Lord Remnant.

The article also gives us more information on Peter Flavel:

Australian-born banker, Coutts chief executive Peter Flavel, took the helm in 2016 after working for Standard Chartered’s Private Bank and JP Morgan.

Born to pub-owing parents, he studied law, economics and commerce at university near his childhood home in Adelaide and Melbourne – he has also attended the Advanced Management Programme at both Harvard Business School and the University of Oxford – before taking a job at National Australia Bank.

In 2006, he moved to Singapore to run Standard Chartered’s Private Bank, then switched to JP Morgan’s wealth management arm.

Last year, there were increasing signs that Mr Flavel, who turned 63 on Tuesday, was becoming increasingly enamoured with issues such as inclusivity and climate change.

The executive shared posts about ‘benefitting the environment and people of all identities and backgrounds.’

‘Each and every one of us has the power to create change,’ he says on the bank’s website.

In an interview in 2019, he revealed he was an adherent to working from home before it became the norm, saying he liked to do so once a month at his West London flat, which the father-of-three shared with wife Ally.

‘Sitting there on our little balcony overlooking the garden fills you with so many new ideas,’ he said.

I bet it does.

No doubt he had a cheery lockdown period during the pandemic, while others, without the privilege of a back garden or a balcony, were told to stay at home, without even so much as a walk to a park.

Why banks are closing accounts

Anti-money laundering laws in the UK are very strict and banks spend a lot of money monitoring certain accounts. If memory serves me correctly, they spend £150 for every £1 they discover is laundered. Therefore, it is much cheaper to close suspected accounts than to keep them open.

Ironically, it was NatWest which was responsible for a landmark case involving money laundering.

On December 13, 2021, the BBC reported:

NatWest has been fined £265m after admitting it failed to prevent money-laundering of nearly £400m by one firm.

A gold trading business suspected of money-laundering deposited £700,000 in cash into one NatWest branch in black bin bags, a court heard on Monday.

A criminal gang deposited huge sums of cash across about 50 branches, prosecutors for the UK’s financial watchdog said.

NatWest said it deeply regrets failing to monitor the customer properly.

It is the first time a financial institution has faced criminal prosecution by the Financial Conduct Authority (FCA) under anti-money laundering laws in the UK.

The fine would have been much higher, but it was reduced because the bank had pleaded guilty, the judge said at the sentencing hearing …

The bank’s chief executive Alison Rose said: “NatWest takes its responsibility to prevent and detect financial crime extremely seriously.

“We deeply regret that we failed to adequately monitor one of our customers between 2012 and 2016 for the purpose of preventing money-laundering.”

How this happened beggars belief. It would make a great movie:

Bradford jewellers Fowler Oldfield’s predicted annual turnover when taken on as a client by NatWest was £15m. But it deposited about £365m over five years, including £264m in cash.

The company, which was shut down following a police raid in 2016, was initially marked as “high-risk”, but that was downgraded in December 2013.

The FCA’s lawyer Clare Montgomery said there “was a rapid escalation in the amount of cash” being deposited from November 2013, with figures reaching up to £1.8m a day. By 2014, Fowler Oldfield was NatWest’s “single most lucrative” client in the Bradford area.

Southall received about £42m in cash between January 2015 and March 2016, for example, but no report was made that it was suspicious.

That is despite lawyers saying earlier on Monday that one person in Walsall arrived at a branch with so much cash, packed in bin-liners, that they broke and the money had to be repacked.

Ms Montgomery added that the cash did not even fit in the branch’s floor-to-ceiling safes.

NatWest did not properly look into numerous warnings generated by its systems, the FCA lawyer said earlier on Monday.

One rule designed to flag suspicious activity was disabled by the bank because it created too many alerts, “so the bank decided it should be deactivated”, Ms Montgomery added, while NatWest also recorded cash deposits by Fowler Oldfield as cheques between 2008 and March 2017.

The National Crime Agency also raised concerns at one point because of the high number of Scottish banknotes being deposited in England, the court heard.

And a NatWest cash centre in north-eastern England raised queries about Scottish banknotes, saying that they had a “musty smell”, suggesting they might have been stored rather than in normal circulation.

The state-backed bank was “in no way complicit in the money-laundering which took place”, the judge said at Southwark Crown Court on Monday.

But they added: “Without the bank’s failings, the money could not have been laundered.”

Sara George, partner at Sidley and a former prosecutor for the Financial Services Authority, told the BBC that it was clear there were failings at every level.

“It’s hard to imagine a much more clear indication of criminal proceeds than black bin-liners of money. It’s extraordinary,” she said.

She added that the “landmark” case showed that the UK’s financial watchdog was “committed to using a fuller spread of its enforcement powers” to stop money-laundering, which she described as “anything but a victimless crime”.

Luckily for Alison Rose, ESG saved her — until Coutts closed Farage’s accounts.

The Telegraph explains in ‘How Britain turned against self-righteous bosses’:

Dame Alison Rose had a spring in her step as she greeted NatWest staff and shareholders in April [2023].

Speaking at an annual gathering at the bank’s sprawling headquarters on the outskirts of Edinburgh, the chief executive had recently received one of the highest awards in the King’s first honours list.

She was also the first NatWest boss to get an annual bonus since the financial crisis.

Since winning the top job in 2019, Dame Alison had been feted not just for her banking nous but for championing corporate “values” and “purpose”, buzzwords embraced heartily by fellow blue chip executives.

“Our values are at the heart of how we deliver our purpose-led strategy,” she told the gathering.

Under her leadership, NatWest had come to describe itself as “a relationship bank for a digital world”. Its values are “being inclusive, curious, robust, sustainable and ambitious”.

They are laudable aims. Yet these same values would be Dame Alison’s undoing, as they were applied in ways she may never have imagined.

In a now widely reported dossier first revealed by The Telegraph, overzealous employees at Coutts, a private bank and subsidiary of NatWest, explained at length why they believed the group’s inclusion or “ESG” (environmental, social and governance) policies meant they should no longer provide services to Nigel Farage …

It is a fiasco that has thrust corporate values and so-called “woke capitalism” into the spotlight, underlining the risks companies can expose themselves to when they wade into politics and social causes …

… the birth of the modern ESG movement has been credited to a paper published by the United Nations in 2004. “Who Cares, Wins” claimed that companies applying these principles were not just doing the right thing but also made themselves more competitive.

The ideas have gained traction in the C-suite ever since, as big businesses seek to downplay the “greed is good” culture that critics blamed for the financial crisis.

Perhaps no British bank embodied this transformation as much as NatWest, previously known as Royal Bank of Scotland.

Under former chief executive Fred “the Shred” Goodwin – dubbed “Britain’s most notorious banker” – RBS embarked on a global takeover spree, briefly making it the world’s biggest bank before it crashed spectacularly. It was bailed out in 2008 to the tune of £46bn in taxpayer cash, and Goodwin became a lightning rod for public anger.

By contrast, Dame Alison’s public image could not have been further from Goodwin’s. A bank lifer who joined as a trainee, she spent years patiently climbing the corporate ladder and, later, cleaning up the disgraced investment banking division of RBS.

When she succeeded Ross McEwan as chief executive a year later, she immediately set about replacing the RBS brand with the less toxic NatWest one, while launching a company-wide process to find the lender’s “purpose”.

“I truly believe that if you are going to lead an organisation and create an organisation that has value over the long-term, it has to be purpose-led,” she told the Blueprint for Better Business podcast last month …

But as the ESG movement has grown, and a cottage industry of consultants, spinners and auditors have sprung up around it, so too have the risks of companies getting things wrong.

How true. In other words, ‘go woke, go broke’. The article has several other examples, from Unilever to Mars confectionery.

The view from Ireland

And, finally, we have an expression of gratitude from Ireland for Nigel Farage’s heroic efforts in the bank account closure debacle from Gript‘s John McGuirk:

… he has been unwilling to make any compromises in order to be liked by the sort of people who despise the things he believes in. In this case, for example, the easier thing would undoubtedly have been to say nothing and find a new bank – but by refusing to go quietly, it has ended up being the Natwest CEO, Dame Alison Rose, who needs to find herself a new bank.

And the Farage row has won a victory not only for himself, but for others: Because if they can’t do it to Nigel Farage, the architect of Brexit and just about everything else that people like Fintan O’Toole consider to be pestilent, then it has become much harder to do it to any of the rest of us.

There is no doubt in my mind, for example, that had they gotten away with doing what they did to Nigel Farage, then just about anyone prominent who stubbornly hangs onto the view that men and women are born, not assigned, would have found themselves without a bank in short order. The same would be true of anyone in Ireland prominently associated with protests about immigration.

That, after all, is how society works now: The ruling liberal order is maintained through a strict regime of incentives and punishments. If you want to keep your job and your nice life, keep your mouth shut.

We owe Farage for challenging that, and preserving the very essence of what it is supposed to be to live in a free society: The right to say loudly and proudly, without fear of punishment, that the people who are ruling your country are buffoons …

Farage has always been hated precisely because he punctures that and appeals to something more enduring: The common wisdom of the ordinary person who knows that what they are hearing is nonsense, but lacks the confidence to argue with “experts agree”. That, above all, is why they hate him, and why they try to shut him up at every opportunity.

It is also why, as in this case, he keeps winning. Lest this sound like an homage, there are many things this writer differs from Farage on – Brexit being just one. But in Farage versus Natwest, as in so many things before, he has once again shown that his existence is something for which every true democrat should be thankful.

If they’d gotten away with doing this to him, the rest of us were next in line.

Well said!

I will be moving on to other topics this week, so I hope this will be the last banking post for a while.