Yesterday’s post provided an update on Nigel Farage’s bank account closure, the 40-page report on him from Coutts and the attention it attracted in Parliament during Rishi Sunak’s PMQs.

Something unusual happened later in the day: an apology to Farage from Dame Alison Rose, the head of NatWest Group, parent company of Coutts.

Perhaps Rishi Sunak’s tweet prompted her to act:

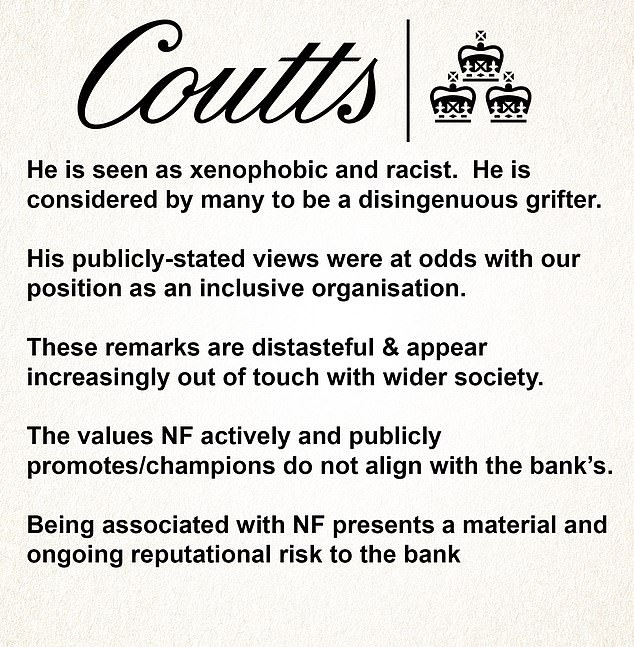

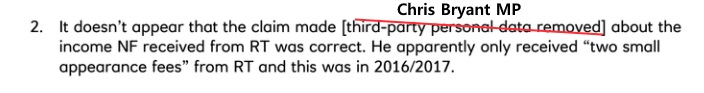

This is a potted recap of what the Coutts report said about Farage:

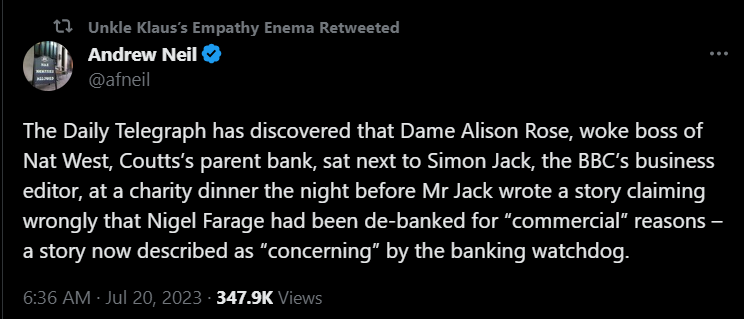

Or perhaps it was because of an allegation that the banking watchdog found the circumstances of the BBC story about Farage’s bank account ‘concerning’:

Hmm.

Thanks to others who posted various screen grabs online, including the letter of apology:

However, note that there is no apology for the fact that someone breached Farage’s privacy to bring about the BBC story and no offer of reinstating Farage’s Coutts accounts.

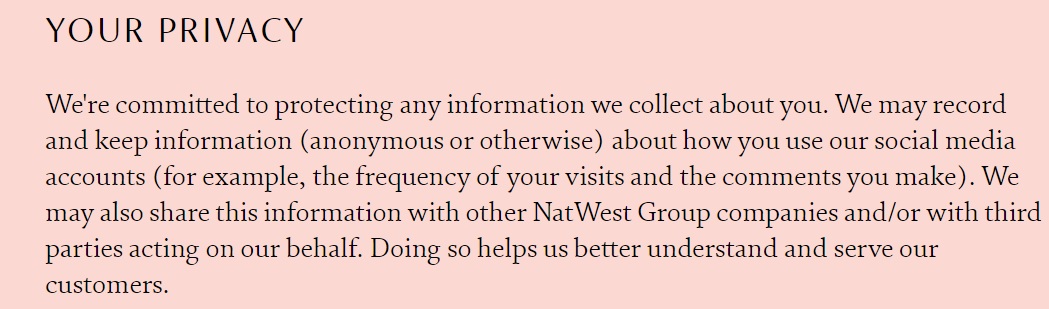

On the subject of privacy, here is the Coutts policy:

It pledges a commitment to ‘protecting any information we collect about you’. Therefore, the BBC story never should have seen the light of day.

However, Coutts is interested in its customers’ use of social media and ‘information’ it receives about that use, ‘anonymous or otherwise’, including ‘the frequency of your visits and the comments you make’, because it ‘helps us better understand and serve our customers’.

That’s an interesting way of putting it.

Guido Fawkes has posted the report from the Group Reputational Risk Committee in its entirety.

Guido says (red emphases his):

Coutts has faced an almighty PR headache since it was revealed they de-banked Nigel Farage for political reasons, and co-conspirators can now read those reasons for themselves. Coutts made the decision based on Farage’s “publicly-stated views that were at odds with our position as an inclusive organisation.” This is the same “inclusive” organisation that excludes anybody with a bank balance below £1,000,000. The bank then claims somewhat incoherently “this was not a political decision but one centred around inclusivity and Purpose.”

Digging deeper into the dossier, and the full extent of Farage’s (completely legal) crimes become apparent. The bank claims Farage is seen as “xenophobic and racist” – a statement they base on his criticisms of BLM and his description of Grant Shapps as “globalist”. They also cite his support for a referendum on Net Zero as “not in line with the banks views”. Amongst Farage’s other thought crimes were his support for the current UK government’s Rwanda policy, his description of Prince Charles as “stupid” and his “comments on women’s football”…

Once again, I commend the report to readers, especially the first two pages. Page 2 states that a third party organisation would ‘undertake monthly Adverse Press checks on NF’ with a view to ‘an earlier exit to be considered if an event occurs that amplifies the reputational risks associated with banking NF’.

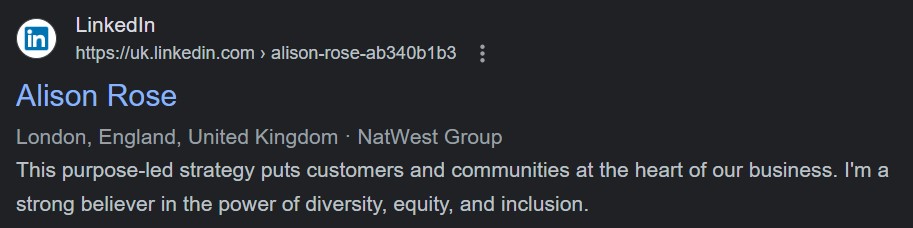

Looking at the report’s mention of ‘Purpose’, as Guido cited, here is what Dame Alison Rose’s LinkedIn profile says:

Addressing ‘reputational risks’, Andrew Neil pointed out the mote in Coutts’s eye, mentioning that, in 2022, The Times reported the bank allowed the then-Prince of Wales’s Charitable Fund to deposit a suitcase with €1million cash from the controversial former Qatari prime minister. Neil asks about the ethics involved there versus Nigel Farage’s reputation. He is not wrong:

Coutts’s report on Farage found no financial impropriety on his part:

Dame Alison Rose read history at Durham University yet heads the huge NatWest Group, likely because she has been working for NatWest since 1992, having begun her career as a management trainee. She graduated from Durham the year before.

In 2018, she led a Treasury review on barriers for women in business. Lucky her. It catapulted her to the top of the tree:

The Rose Review found that just one in three UK entrepreneurs is female and only one per cent of venture funding goes to all-female teams.[14] In November 2018, she became deputy chief executive of NatWest Holdings.[15][16]

In March 2019, the UK Government published a policy paper, the Alison Rose Review of Female Entrepreneurship.[13][17] In April 2019, Rose was “widely-tipped” to succeed Ross McEwan as CEO.[7][15][18]

Rose was the chief executive of commercial and private banking at Royal Bank of Scotland Group and deputy chief executive of NatWest Holdings.[7][19] In September 2019, it was announced that she would succeed Ross McEwan as CEO of RBS Group on 1 November 2019, making her the “first woman to lead major UK lender”.[20] RBS Group was re-named NatWest Group in 2020.

Rose was appointed Dame Commander of the Order of the British Empire (DBE) in the 2023 New Year Honours for services to the financial sector[21][22] and later that month she was given an honorary degree by the new Chancellor of York University Dr Heather Melville.[23]

She is married to David Slade, who works for UBS. The couple have two children and live in Highgate (north London).

However, Dame Alison is not the only one who has made great strides in her banking career.

On July 3, Wings Over Scotland featured a profile of HSBC’s global lead on financial tracking. This, too, is of interest:

Hannah Graf MBE (below, right, receiving the decoration from Prince William in 2019 for his “work updating LGBTQ policy in the British Army”) is a very strange fella …

After joining the army straight out of university in 2009 and spending several years in it as a (gay) man, Graf “transitioned” to female in 2013. “It was literally an overnight thing, where one day I went home as a male officer and next day I came in as a female officer”, he told Channel 4 in 2021 in his still-deep and unmistakably male voice.

(He’d also appeared on the BBC six years earlier, under his original surname of Winterbourne, but his birth first name appears to have been scrubbed from history.)

But the really curious thing is that having spent the latter years of his military service as a glorified party-planner working in HR and recruitment, Graf inexplicably then walked straight into a senior job in financial-crime prevention with a big-four bank (HSBC), despite having precisely zero previous experience in finance, crime or banking.

One day just one of the lads, next day brave and stunning lady. One day squaddie, next day international money-laundering detective. Hannah’s quite the chameleon.

But I digress.

The Telegraph had several articles on the Farage story, published on Thursday night for Friday’s edition.

Reactions

Nigel Farage was broadcasting live on Thursday from Newport in Wales, one of his fortnightly visits around the country. He covered the apology in the opening segment (7:05 mark):

In ‘Farage bank scandal: NatWest and Coutts chief Dame Alison Rose apologises’, The Telegraph reported (purple emphases mine):

In a letter to Mr Farage, she said: “I am writing to apologise for the deeply inappropriate comments about yourself,” adding: “I would like to make it clear that they do not reflect the view of the bank.”

Mr Farage said he welcomed the apology, but believed she had been forced into it by the Treasury.

On his GB News show, he said he was “going to find out” if Dame Alison leaked his banking information to the BBC.

“On July 3 you were having dinner sitting next to the BBC’s economics correspondent Simon Jack,” he said, pointing out that the journalist rang him the next morning and posted on Twitter that his account had been closed because there was not enough money in it.

“The BBC put that out and many in the media accepted that version,” he said.

“Mr Jack for some reason seems to have gone to ground today and hasn’t backtracked from it.

“Can I ask you, Dame Alison, was it you? Was it you that breached my private client banking confidentiality? Was it you that told Simon Jack that?

“Well, I’m going to find out, because today I’ve put in another subject access request, this time to NatWest bank and in particular I’m looking for any personal correspondence, Dame Alison, that concerns me. So in 30 days’ time, we’ll know the absolute truth.”

The article helpfully mentioned that Farage filed:

a subject access request, which gives people the right to ask companies for a copy of any personal data held on them, under data protection laws.

The Information Commissioner’s Office has instructions on how to file a subject access request, which any member of the British public can do.

One of the criticisms Coutts made was that Farage supported Donald Trump. The Telegraph managed to contact the former president’s son Eric, who said:

For a bank to cancel an individual because of their political party or individual beliefs is asinine and dangerous.

A bank’s sole purpose is to safeguard and manage people’s money – not to infringe on their clients’ freedom of speech via threat of cancellation.

Citizens of the UK should be very fearful. If this can happen to Nigel Farage, it can happen to anyone – especially people who don’t have a public platform, voice, or ability to fight back.

The article also reported what Conservative MP and GB News presenter Jacob Rees-Mogg said:

Jacob Rees-Mogg, the former business secretary, called on NatWest to hold an inquiry into the leak – and sack the person responsible for it.

“If you are a public figure, you know your life is very public,” he said.

“There are a very small number of people you think who will maintain this confidence – your doctor, your bank manager, your accountant, and your lawyer.

“If you cannot rely on your bank to keep your information secret, then who can you deal with? It’s such a breach of trust.

“The bank should have an inquiry to find out who leaked this, and however senior the person is who leaked it, they should no longer be a banker. After all, a doctor who gossiped about a patient’s health condition would be struck off.”

Another Conservative MP, Andrew Griffith, said that new legislation would soon be in force for banks in this regard:

The Treasury announced earlier in the day that British banks will be subject to stricter rules over closing customers’ accounts – with Andrew Griffith, the City minister, warning that freedom of speech was the “cornerstone of our democracy”.

Banks will be forced to give a customer an explanation of why they are closing an account and will have to give them three months’ notice.

Mr Griffith said: “Banks occupy a privileged place in society, and it is right that we fairly balance the rights of banks to act in their commercial interest, with the right for everyone to express themselves freely.”

A third Conservative MP, Michael Fabricant, was unimpressed with the NatWest Group chief’s apology:

Sir Michael Fabricant, the Tory MP, called on Dame Alison to consider her position, saying: “Alison Rose will not have reassured customers with her response. She did not address the leaks which were a disgrace from a licensed bank. Nor has she offered Mr Farage his account back.

“In 2023, banking facilities are as vital as water or electricity supplies. It is a utility. Alison Rose should now seriously consider her future in banking.”

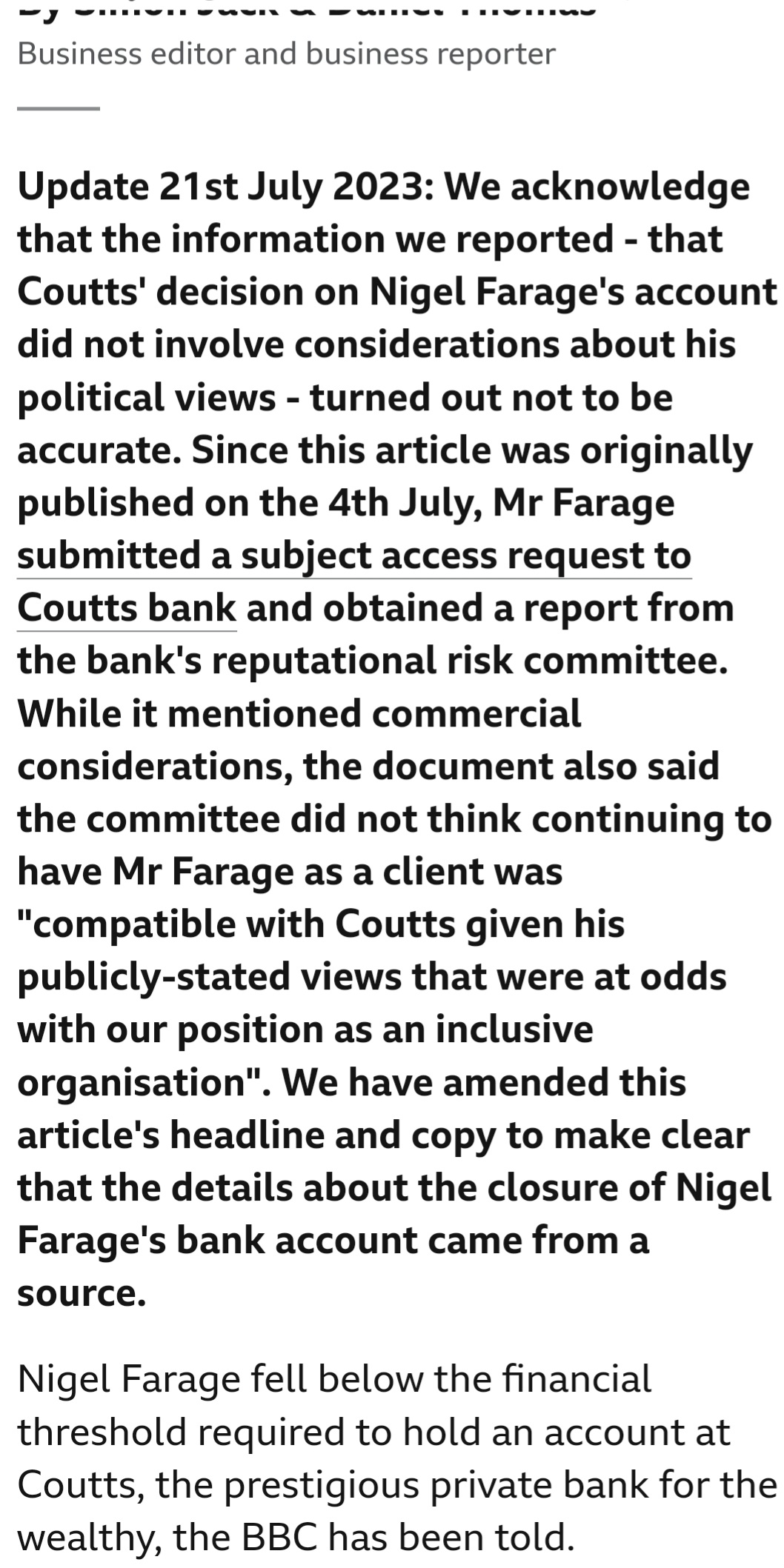

Meanwhile, the BBC had not yet apologised for reporting that Farage’s accounts were closed for financial reasons. That said, they finally retracted that part of the story in the 6 p.m. news bulletin:

On Thursday’s BBC News at Six, viewers were told that the broadcaster had previously quoted a source who rejected the notion that the decision to close Mr Farage’s account was in any way political and claimed it was a commercial decision.

The presenter said that information had been inaccurate. The report did not reveal who the source was.

It wasn’t until Friday, July 21, that Simon Jack wrote a retraction to a July 4 article:

Dame Alison and the BBC

On Wednesday, July 19, The Telegraph filed the story, ‘Bank chief Dame Alison sat next to BBC journalist night before he tweeted claim about Nigel Farage’:

The Grand Ballroom of London’s Langham Hotel is marketed as a luxurious space “where business meets pleasure”.

With its gilded pillars and spectacular chandeliers, it is the perfect setting for fundraising dinners where the great and the good gather to mix fine dining with philanthropy.

It is a splendid, traditional hotel — and is right across the street from the BBC in the heart of the capital.

The article continues:

One such occasion was this year’s BBC Correspondents’ Charity Dinner, held in aid of BBC Media Action. It was a glitzy affair, with tables hosted by the likes of Naga Munchetty, Jeremy Vine, Reeta Chakrabarti and Fergus Walsh, whose star power helped to draw in the sort of wealthy individuals who could make the night a success for the charity.

Another of the correspondents attending the event was Simon Jack, the BBC’s business editor and part-time presenter of Radio 4’s flagship Today programme.

Sitting by his side was Dame Alison Rose, the chief executive of NatWest bank. Other guests described them “laughing and joking together” during the meal …

The dinner took place on July 3, on the same day that the Daily Telegraph’s lead story reported the Chancellor’s “deep concerns” about banks blacklisting customers who hold controversial views.

One of those customers was Nigel Farage, who had disclosed days earlier that his accounts with Coutts had been closed “without explanation” but that he was convinced it had been done for political reasons.

Mr Jack, as BBC business editor, would naturally have taken a keen interest in the story, and happened to find himself sitting next to the boss of the bank that owns Coutts, Dame Alison.

Whether the two discussed Mr Farage, neither is prepared to say.

What is known, however, is that the next day, July 4, Mr Jack published an exclusive story on the BBC website headlined: “Nigel Farage bank account shut for falling below wealth limit”.

It quoted “people familiar with Coutts’ move” claiming that it had been a “commercial” decision to close Mr Farage’s personal and business accounts because he did not have enough money.

Both the BBC and NatWest declined to comment when the Telegraph asked what Mr Jack and Dame Alison had discussed during the meal.

Dame Alison has already come under pressure from MPs to resign after the matter escalated all the way to Downing Street, with Rishi Sunak saying Coutts’ actions had been “wrong” …

Mr Farage does not dispute that his finances dipped below the Coutts threshold of £3 million in savings or £1 million in borrowing or investment, but says the bank had never made an issue of it in the past. The document obtained by him also makes clear that he was considered a commercially viable customer.

According to Guido, the BBC were still at it this week. He provided a clip from a woman the network describes as a ‘banking’ and ‘financial’ commentator, Frances ‘Cassandra’ Coppola, who discussed Farage’s account closure with him present during a Newsnight segment:

Once again, the BBC is being economical with the truth.

Guido tells us:

Yet again, the BBC is failing its basic duty to provide transparency to viewers. In a discussion about Nigel Farage’s de-banking, Newsnight invited on Frances Coppola to provide an opposing view. Before claiming Farage’s views were unrelated to the bank’s decision, despite the 40-page dossier which explicitly claims banking Farage was “at odds with our position as an inclusive organisation“, Frances was introduced simply as a “banking commentator” and then a “financial commentator”. That introduction is inadequate.

Frances is more than a banking commentator – in her own words, she’s also a “broke centrist remoaner”. Looking further into her Twitter history only confirms this…

He provided a tart selection of tweets showing that this woman is clearly biased.

Agreed, but how can one take seriously a financial commentator who has the need for a fantasy name? ‘Cassandra’? Really?

Guilt by association

Veteran columnist Simon Heffer wrote an article for The Telegraph explaining how he had a financial blip after his bank linked him with Nigel Farage:

Four months ago, just before the end of the tax year, the very decent and capable man who advises me on my pension provisions dropped me a routine email.

He said that to cut my tax liability I should top up my pension fund before April 5. I did: but shortly after I had made the transfer of funds from my bank, he rang me in what I detected was a state of mild embarrassment.

Someone – I am not sure whether at the financial services firm for which my adviser works, or at the fund in which my pension is invested (a Standard Life SIPP) – had asked for more information about one aspect of my life before finally processing my additional investment.

Bemused, I asked what information they wanted – not being engaged in Russian sanctions-busting, money laundering or working as an agent of Beijing, I felt I had nothing to hide.

However, one of these institutions thought I had done something exceptionally dodgy: I was a friend of Nigel Farage.

This took me somewhat by surprise. I am indeed a friend of Nigel, whom I have known for 30 years. But we are not – how shall we say? – intimate. We have no business association of any description. I see him two or three times a year …

A lot of my friends do not know I am a friend of Nigel Farage. So how on earth did people in the financial services industry who handle the highly confidential area of my investments know it? And why, to put it bluntly, was it any of their bloody business?

My adviser was quite straight with me and told me my association with Nigel (if it can be aggrandised by that term) was of interest to the financial services industry because he was “a politically exposed person”, a term that, in my innocence, I had never heard up to that moment.

I made the nature of my association with Nigel clear to my adviser – and underlined the point that I do not have, and never have had, a financial relationship with him. My adviser was quite satisfied, my investment was accepted, and I put what seemed like an odd, but minor, matter behind me …

Had I had nothing to do at the time I would have made a point of looking into the question of what makes a politically exposed person, and indeed how and why someone had made it his or business to determine that I was a pal of one – and that details of Nigel Farage’s friendships and associations appear to have been shared right across the financial services industry.

But I was, at the time, taking on a pile of extra work tied to the impending Coronation, and working through the copy-edit of a 350,000-word book, and was too busy to think about it. I didn’t even get round to telling Nigel about this absurd incident. I now know he wouldn’t have been in the least surprised. But I now see it stinks to high heaven, in an attempt to weaponise the financial services industry on behalf of a whole political ideology against an opposing set of values …

My former colleague Dominic Lawson has written of problems he encountered trying to open a bank account for his daughter, who has Down’s syndrome: the problem was that his late father, Nigel Lawson, a man of impeccable probity, had had the effrontery to challenge the orthodoxy of climate change, and therefore was “politically exposed”.

The list of questions that Coutts has to answer is set to get longer …

In sharing such information as they found – such as who his friends were – were there breaches of data protection? Do I, and countless others, have a case in law against those who compiled the list of Farage friends? Indeed, never mind what improprieties have been perpetrated towards such friends and associates, what about the leak of confidential (and apparently false) information about his finances to the BBC? For that reason alone, shouldn’t Dame Alison have resigned? How can she begin to defend her behaviour?

In the sinister, public-relations driven obsession with diversity, inclusion and something called “equity”, institutions will now, it appears, say and do anything to appear to be on the right side of the woke orthodoxy. This now seems to include not just sacking customers for exercising their freedom of speech within the law, but digging dirt on them in a highly questionable fashion, and seeking to impede the financial lives of entirely innocent associates whose only crime is to be friends with people whose political views the diversity industry condemns. I wish I had an account with Coutts or NatWest, just so I could have the rapture of closing it.

Boris Johnson’s brother-in-law Ivo Dawnay — married to Rachel — also had a weird experience. Mexican officials had associated the two from his passport and denied Dawnay an exchange of dollars into pesos at the Mexico City airport. He wrote about this strange episode for The Spectator on July 8:

Nigel Farage and I don’t have too much in common beyond liking a pint and a cigar. Yet I now discover a link: we are both PEPs, or ‘politically exposed persons’. Such a handle may not be a total surprise to Nigel. (He may not have been surprised, either, when Coutts said that it had closed his bank account simply because he didn’t have enough funds.) But it certainly was to me – especially as I found out from an official at the bureau de change in the baggage hall of Mexico City airport.

As I proffered a couple of grubby $100 bills to change to pesos, I filled in a short form – name, address etc – then noticed the cashier looking quizzically at my passport. He called over a supervisor. My passport was analysed by a machine. After a few buzzes, bleeps and whirrs, a new form, almost identical to the first, was presented. But as I laboriously listed once again the address of my hotel, I noticed there was an additional question at the bottom. Was I a politically exposed person, it asked …

… as a man in his seventies – an OAP PEP perhaps – surely I couldn’t be too much of a threat to the government of President Andrés Manuel Lopéz Obrador. After all, my $200 was not going to buy many armed-to-the-teeth banditos, given that they are fearfully tied up with the hideously complex logistics of cocaine trafficking, and I am not that good on stairs.

… So it was with confidence that I answered the question with a firm: ‘No.’

A dark frown spread across the manly brow of the supervisor, who returned to his computer, perused the data strip in my (still burgundy) passport one more time and said, with infinite good manners, but brooking no contradiction: ‘I am afraid our computer says you are. We cannot change your money.’

And then I finally understood. Yet another fine thing Boris has got me into. Not only must I forever shrink in my chair at fashionable dinner parties insisting like Cain (or was it Abel?) that ‘I am not my brother’s keeper’. I must now dodge the money-changers in the temples. The sins of the brothers-in-law, it seems, will always be with me, heaped upon my head at the exchange counters of the globe. Even the usurious clerks of Travelex, the ultimate pharisees of our times, will decline to do business with me. There will be an assumption that the $200 I proffer has been snitched from the No. 10 petty cash tin.

‘Don’t worry,’ said the kindly cashier, spotting my consternation. ‘We are a government exchange bureau. Any of the ones outside in the arrival hall will happily take your money.’

Funny peculiar, really. But I do think that Thomson Reuters, who I hear make a tidy profit flogging dog-eared information from their cuttings to the world’s border guards, should be accountable – or perhaps some other free-enterprise data snitch.

If we can legally check our credit ratings, surely the same should be applicable to our relative political radioactivity? Or is that a state secret not to be shared? All I know is someone seems to have been messing with the data strip in my passport – my soon-to-be-surrendered last link to the long-lost European empire over the sea.

On that subject, The Telegraph believes that ‘NatWest faces wave of data requests after Nigel Farage scandal’.

The paper says there were ’13 tweets that cost Nigel Farage his Coutts bank account’.

The paper also has queries: ‘Nigel Farage bank row: 10 questions Coutts and NatWest must answer’.

Heads must roll

Their columnist Alison Pearson says ‘Dame Alison Rose must now resign as head of NatWest’:

Last year, her pay packet was £5.25 million, a big chunk of that courtesy of the taxpayer, who owns 39 per cent of NatWest (and thus Coutts) since its bailout during the 2008 financial crisis. Now, in a desperate attempt to stem the furore over Nigel Farage and his closed accounts at Coutts, she has emailed him to apologise. But fine words butter no parsnips. Dame Alison must resign.

A friend who used to be extremely senior at Coutts, and still keeps in touch with former colleagues, says that the scandal over the private bank terminating Nigel Farage’s account was “depressingly inevitable. The forces of woke have wrought havoc there,” he says, “The trouble is members of staff are bullied into compliance with these ‘progressive’ edicts.”

My friend is appalled at the naivety and delusions of the present executives. “These people think they are invulnerable and have little awareness of the outside world. They talk to themselves and listen only to sycophants who will never gainsay them. If what they are said to have done to Farage is accurate it’s disgustingly disgraceful. I’m ashamed of what the bank has become”…

ESG stands for Environmental, Social and Governance, typically referring to policies that prioritise long-term environmental and social sustainability when making investments and other banking decisions. ESG can include social issues regarding diversity, equity, and inclusion plus the inevitable climate change.

So alarming is the tentacular stranglehold this philosophy has over financial institutions that, back in the spring, Governor Ron DeSantis took steps to ban ESG in Florida. He called it “woke banking”. “What it’s evolved into is a mechanism to inject political ideology into investment decisions, corporate governance, and really just the everyday economy,” said DeSantis. ESG policies were enforced by “elites” in financial institutions to push “woke” political agendas which did not not prioritise financial interests.

Which brings us back to Nigel Farage and Coutts …

Home Secretary Suella Braverman is right to say the Coutts scandal exposes the “sinister nature” of the “diversity, equity and inclusion industry”. The Farage farrago will undoubtedly lose the bank clients. Serious wealth does not like publicity.

“It may score Brownie points with the Islington dinner-party circuit who are not Coutts’ customers anyway,” observes my source, “but it will lose a whole raft of landowners who are naturally conservative, and families who have banked with Coutts for generations. They will be horrified. ‘Why on earth should my political views influence the holding of my account?’, that will be their attitude”…

Perhaps Farage’s clash with Coutts will mark a watershed. An emergency law is set to be introduced to prevent banks “cancelling” account holders. The Government needs to do that quickly. Banks which do not protect the free speech of customers could lose their licences, and rightly so. How dare bankers in their fifties behave like teenage Maoists with other people’s money.

… But we have to keep fighting the good fight for the sake of our children and grandchildren. We just have to.

Thomas Coutts must be spinning in his grave. He was always prepared to bank anyone, especially those who were being persecuted and even went to Paris at the height of the French Revolution to help beleaguered aristocrats. Would Coutts have considered Nigel Farage’s money to be as good as the next man’s? You can bank on it.

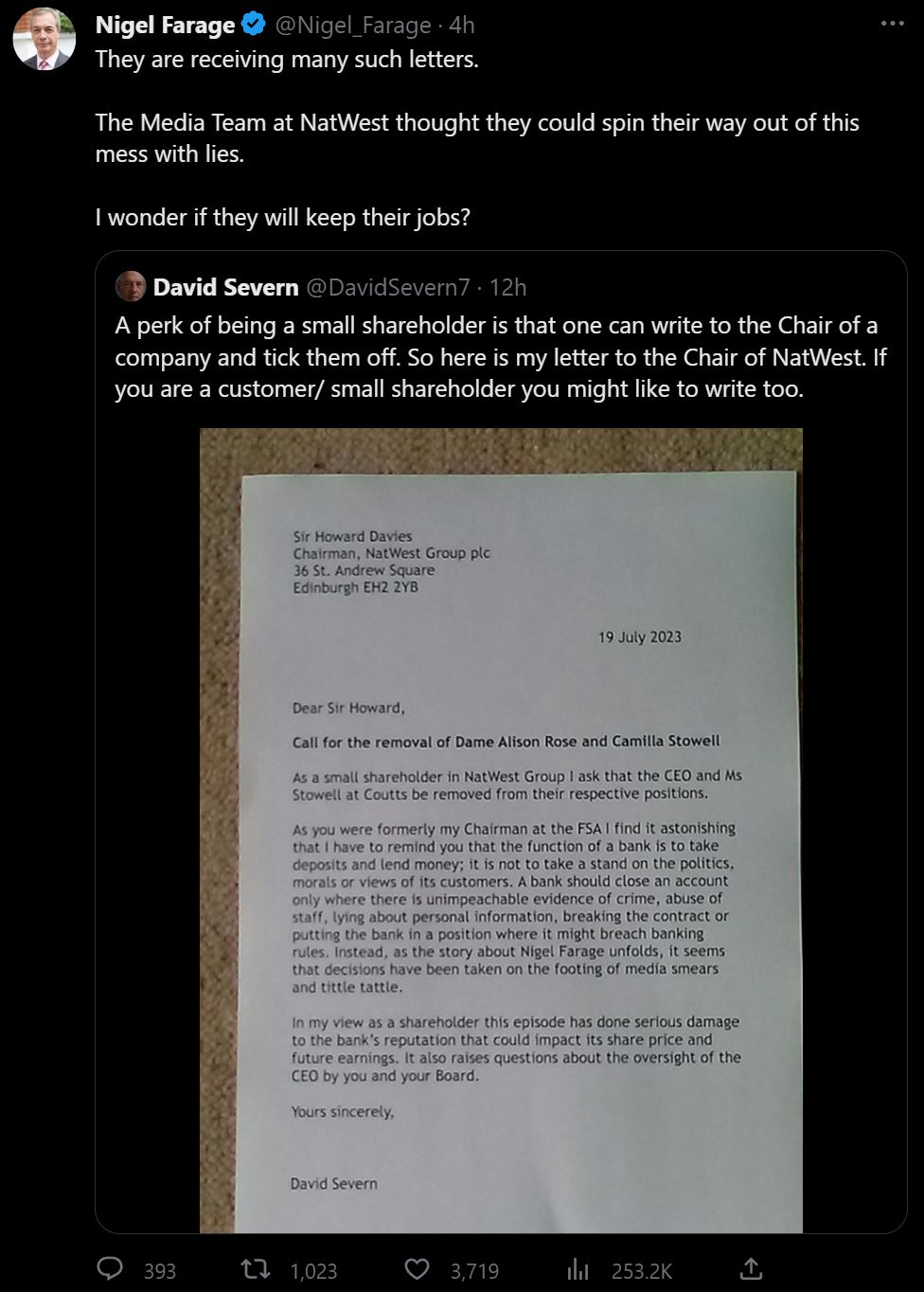

Small shareholders in NatWest have been writing the group’s chairman Sir Howard Davies. One has said that Camilla Stowell of Coutts should also go:

Change is coming

And, finally, The Telegraph‘s ‘Banks to be forced to explain why they close accounts thanks to Brexit’ tells us:

Banks will have to explain why they are shutting down someone’s account under the new rules. They previously have not had to provide a rationale for doing so.

The Government has also extended the notice period for a forced account closure from 30 days to 90 days, which it said gives customers more time to challenge the decision through the Financial Ombudsman Service or find a replacement bank.

The Treasury said the new rules were only possible because Britain had left the EU …

The Treasury said the changes can only be made due to new powers in the Financial Services and Markets Act 2023, which gave the UK control of its financial rulebook following Brexit.

The proposed changes follow a call for evidence launched in January, following PayPal’s temporary suspension of several accounts last year. It found that changes were needed to ensure the right balance is being struck between protecting customers, and providers’ rights to manage commercial risk.

They require secondary legislation, which will be delivered through the powers granted in the Financial Services and Markets Act 2023, as part of the Government’s programme in building a smarter regulatory framework for UK financial services.

This runs alongside separate plans to clarify in legislation the requirements for politically exposed persons, and a review into whether these are being applied proportionately by financial institutions.

The Financial Conduct Authority will set out how they intend to conduct the review by the end of September.

It cannot come soon enough.

Next week I will look at this week’s by-election results in detail: there was a piece of the pie for Conservatives (Uxbridge and South Ruislip), Labour (Selby and Ainsty) and the Lib Dems (Somerton and Frome).

3 comments

July 22, 2023 at 9:59 am

john cheshire

CM, It is good that Nigel Farage has publicised the treatment he has received from Coutts and apparently other banks. And it is good that the government is starting to recognise it as a serious problem.

But

It’s not just Coutts who are the bad actors. I have read that Yorkshire Bank has also been cancelling bank accounts, particularly those held by Christians. That too needs to be publicised and included in the list of banks that the government must give attention to.

I feel strongly that the individuals in the banks who are making these decisions must be made personally accountable. And as a minimum, the bad actors must be fired, if for no other reason than to ‘encourage the others’.

LikeLiked by 1 person

July 22, 2023 at 10:24 pm

churchmouse

Thank you, John, for your well considered comment.

May I just say that it was not Yorkshire Bank but the Yorkshire Building Society in the case of the Anglican vicar:

I agree that Coutts and NatWest are not the only bad actors. Other banks have been closing accounts or refusing mortgages, too. Nadine Dorries had problems with the Halifax, as she wrote recently in the Mail+:

https://www.mailplus.co.uk/edition/comment/nadine-dorries/291243/did-halifax-penalise-me-for-being-a-tory-mp

I cited it in:

Also agreed that heads must roll ‘pour encourager les autres’.

Bring on Madame Defarge.

LikeLike

July 26, 2023 at 10:01 pm

Victory for Nigel Farage as NatWest chief Dame Alison Rose resigns | Churchmouse Campanologist

[…] My last post on Farage’s bank account was dated Friday, July 21. At that point, Conservative MPs were aghast that the head of one of the UK’s largest banking groups would discuss a former customer’s account with a BBC reporter, especially over dinner. While Dame Alison had apologised, the BBC had not. […]

LikeLike