On July 6 and July 12, 2023, I wrote about Nigel Farage’s closed bank accounts and those of other Britons.

Now Conservative MPs have asked for an investigation.

Before we get there, however, this is what happened after I last posted.

I found a July 11 article by Conservative MP Nadine Dorries, who still hasn’t resigned as she pledged, in Mail+. She says she had been denied a mortgage because she was a PEP — politically exposed person (emphases mine):

… as we are now discovering, many banks are using it as an excuse to turn down new applicants or close existing accounts …

Intriguingly, most of the politicians who have fallen victim to this hail from the Right of the spectrum — including yours truly.

Some years ago, as my mortgage was coming to an end, I was refused a new deal by Halifax and told it was because I was a PEP.

It was before this particular EU rule became UK law in 2017 — it was introduced in 2007 but did not become mandatory until a decade later — and I had no idea what the clerk was talking about.

I had to scramble to secure another mortgage, paying double the interest rate of other lenders. I later discovered many MPs were hitting the same wall …

… PEP status can extend to an individual’s family and close associates. Who would want to see wives, sons or daughters debanked because they happen to be related to a PEP …

We’ve no one to blame but ourselves for this. Under Theresa May, we enshrined the legislation a year after we voted to leave the EU. Now we need to get this sorted.

Last month, legislation was rushed through that means banks should adopt a more sensible approach — and a lighter touch when it comes to home-grown politicians who arguably pose far less risk than some suspect foreign applicants who were the original focus of the restrictions.

The relevant new legislation is discussed below.

On Monday, July 17, Farage opened his GB News show with an update on his Coutts accounts. He had managed to obtain information about why they were closed. In the report, Brexit was mentioned over 30 times and Russia over 20 times (start at the 6:50 mark):

On Tuesday, Farage revealed that Coutts said that Farage did not align with its ‘values’. Coutts had compiled 40 pages of media mentions and included some minutes from internal meetings at the bank regarding his accounts. The report was 17801 words long, featuring 83 media articles and citation by Labour MP Chris Bryant alleging that Farage had earned a large six-figure sum from his work for Russia Today. See more on Bryant below.

Start at the 9:30 mark:

He also discussed the revelations with Dan Wootton later that evening:

Later that evening, Farage tweeted the front page of Wednesday’s editions of The Mail and The Telegraph and asked for an apology from the BBC’s Simon Jack, who had intimated days before that Coutts dropped Farage because he did not have enough money in his account:

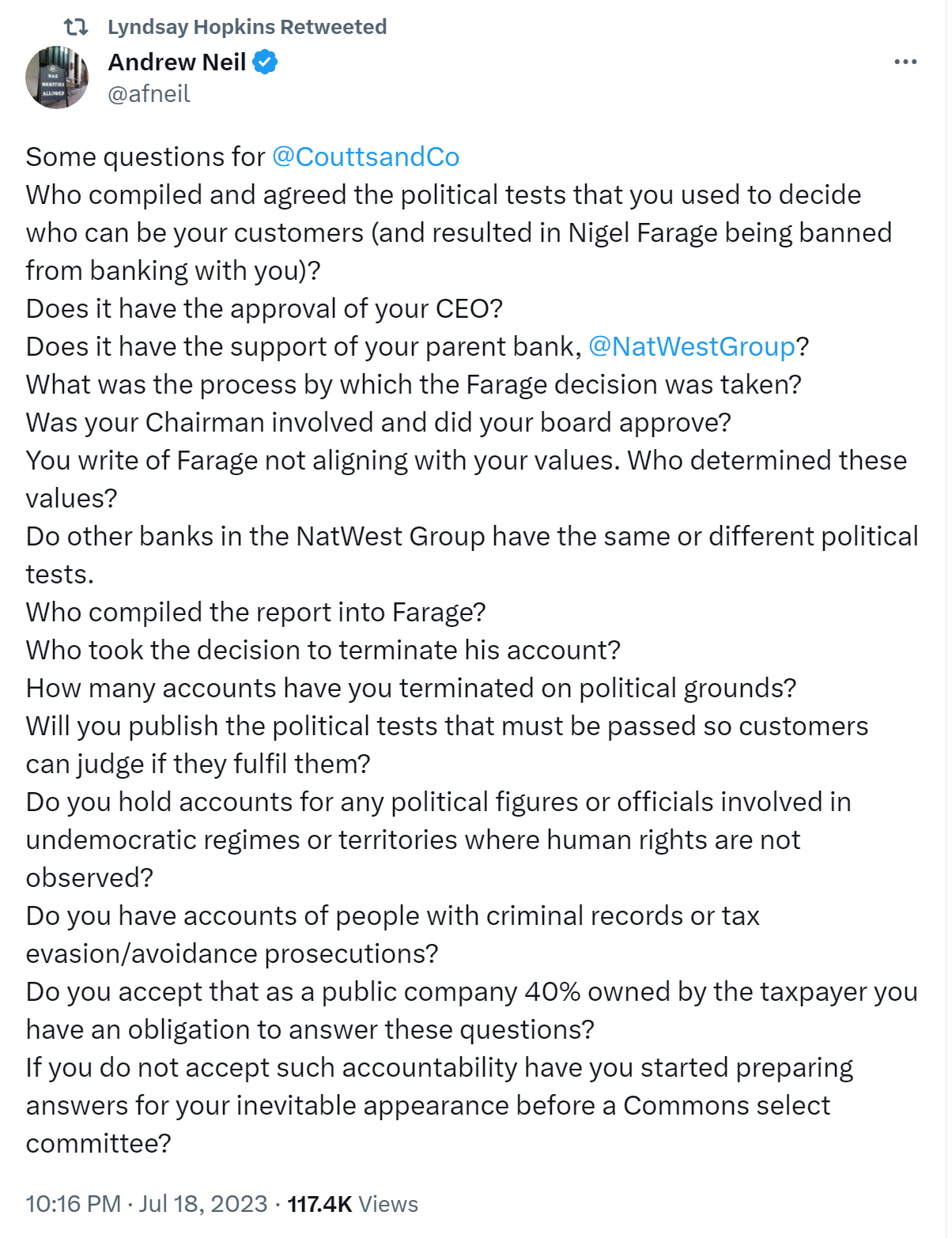

The headines prompted veteran broadcaster Andrew Neil, not a natural Farage ally, to pose the following probing questions to Coutts, all of which need to be answered, preferably before a parliamentary select committee:

On Wednesday, July 19, The Mail had obtained a copy of the full 40-page report on Farage. It is outrageous, describing him as a ‘disingenous grifter’ and said he had not yet been convicted of anything. I would encourage readers to explore it in depth.

Farage did meet the financial criteria, contrary to what the BBC broadcasted some days ago. An apology from them is in order:

The officials noted that closing his accounts could not be justified on the basis of his wealth as his ‘economic contribution’ was ‘sufficient to retain on a commercial basis’.

But the minutes state: ‘The Committee did not think continuing to bank NF was compatible with Coutts given his publicly-stated views that were at odds with our position as an inclusive organisation’ …

The dossier also referred to accusations made by Labour MP Chris Bryant under parliamentary privilege that Mr Farage was paid more than £500,000 by the Russian state – a claim he vehemently denies.

Mr Farage said: ‘This document is astonishing, it’s abusive and it makes a whole series of wildly false statements about Russia while acknowledging I have not been convicted of anything’ …

The Coutts documents, which Mr Farage obtained from the bank through a ‘subject access request’, details discussions by a ‘Wealth Reputational Risk Committee’ on November 17 last year.

They read: ‘The committee did not think continuing to bank NF [Nigel Farage] was compatible with Coutts given his publicly-stated views that were at odds with our position as an inclusive organisation.

‘This was not a political decision but one centred around inclusivity and purpose.’

The dossier noted that there was ‘no evidence of regulator or legal censure’ of Mr Farage, that he was ‘professional, polite and respectful’ to staff and that he had recently been downgraded from a ‘higher risk politically exposed person [PEP]’ to lower risk, and was on the way to being classed as no risk at all …

The dossier includes a lengthy piece of research apparently conducted for the bank on Mr Farage’s previous political positions and controversies.

‘Given NF’s high profile and the substantial amount of adverse press connected to him, there are significant reputational risks to the bank in being associated with him,’ it said.

‘While it is accepted that no criminal convictions have resulted, commentary and behaviours that do not align to the bank’s purpose and values have been demonstrated.’

In one section the assessment warns that he is seen as ‘xenophobic and racist’ and a ‘disingenuous grifter’.

The Telegraph‘s Gordon Rayner featured an article about the Coutts report:

A reputational risk committee “exited” Mr Farage after considering a dossier detailing his comments about Brexit, his friendship with Donald Trump and his views on LGBT rights among many reasons he was not “compatible with Coutts” …

Earlier this month, the BBC and the Financial Times reported claims that the reason Mr Farage’s accounts were closed was that they fell below the financial threshold required by the bank. The BBC quoted sources “familiar with” the Coutts decision.

Yet in the 40 pages of documents released to Mr Farage after he made a subject access request to Coutts, the bank repeatedly says he “meets the EC [economic contribution] criteria for commercial retention”.

Writing for The Telegraph, Mr Farage accuses the private bank of “lying” about the real reason he was cut off, saying the documents show that the decision was politically driven …

“Between 2014 and 2016, when I first banked with Coutts, no problems ever arose. After Brexit became a reality, everything changed,” he writes.

Minutes of a meeting of Coutts’ wealth reputational risk committee held on Nov 17 2022 state: “The committee did not think continuing to bank NF was compatible with Coutts given his publicly-stated views that were at odds with our position as an inclusive organisation …

The Coutts committee decided to put him on a “glide path” to being ejected, with his personal and business accounts to be closed when his mortgage deal ended this year.

Mr Farage now says he cannot get an account with any other bank, having been turned down by 10 banks since Coutts withdrew its services. Members of his family have also been refused accounts by other banks, and one family member was told their account was being closed.

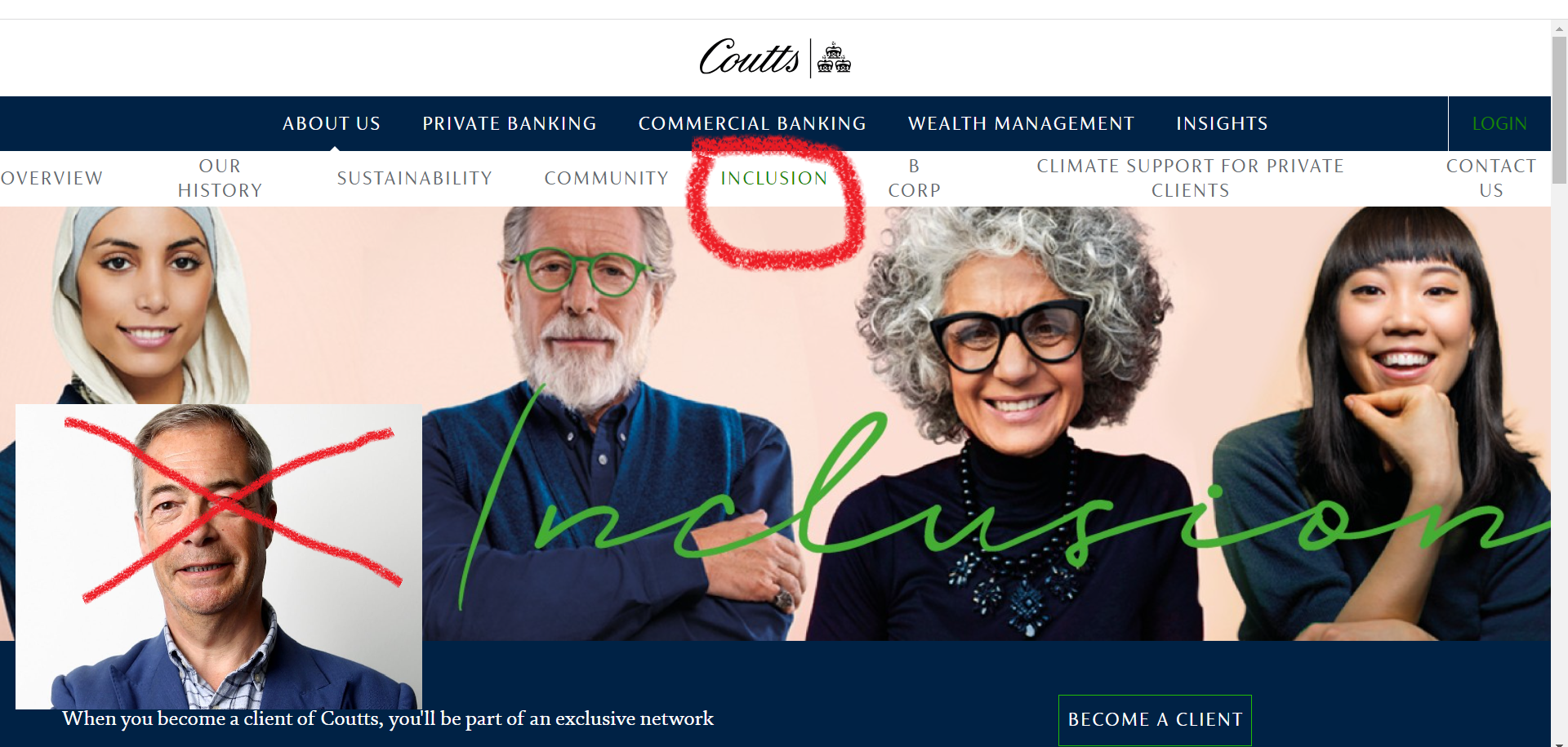

Someone online posted this mock-up of the bank’s home page:

Early that afternoon, two Conservative MPs spoke up at PMQs about banks cancelling customers accounts. Rishi Sunak said he would ask for an investigation.

Jacob Rees-Mogg asked Sunak:

Does my right hon. Friend share my unease that a bank that has the Government as its largest shareholder should close the account of a senior opposition politician? Will he use the Government’s shareholding to ensure that there is an inquiry into those circumstances, because the subject data access request makes it clear, or certainly indicates, that it is the political views of the person concerned that led to his cancellation? Does my right hon. Friend agree that, however much we may find them tiresome, members of the opposition deserve bank accounts?

Sunak responded:

It would not be right if financial services were being denied to anyone exercising their right to lawful free speech. Our new Financial Services and Markets Act 2023 puts in place new measures to ensure that politically exposed persons are being treated in an appropriate and proportionate manner, and having consulted on the payments services regulations, we are in the process of cracking down on that practice by tightening the rules around account closures. But in the meantime, any individual can complain to the Financial Ombudsman Service, which has the power to direct a bank to reopen their account.

Guido Fawkes has the video:

Guido commented:

It’s a bad day to be Coutts’ PR team. Since Nigel Farage revealed his account had been closed for political reasons and not, as reported credulously by the BBC and others a little too gleefully, because Farage fell below the wealth threshold, the bank has been on the receiving end of a harsh backlash. At PMQs today, the issue was bought up by both Jacob Rees-Mogg and David Davis, and Norman Lamont has secured a question in the Lords. The government is also not sitting idly by: Suella [Braverman, Home Secretary] slammed the “sinister” decision and said she would review relevant Home Office policy …

Near the end of PMQs, David Davis returned to Rees-Mogg’s question:

To bring the Prime Minister back to the question asked, rightly, by my right hon. Friend the Member for North East Somerset (Sir Jacob Rees-Mogg), the opposition politician referred to is Nigel Farage, whose bank account was closed not because he was a PEP—a politically exposed person—or for commercial reasons, but because his views did not align with the values of Coutts bank: thinly veiled political discrimination and a vindictive, irresponsible and undemocratic action. In addition, Nat West also disclosed confidential details about Farage’s account to the BBC and lied about the commercial viability of his account, actions that should jeopardise its banking licence and should certainly worry Nat West’s 19 million other customers. The Prime Minister has told us what he will do in the future, but there are many other people in this circumstance. Will he require every bank with a British banking licence to inform the Treasury of all the accounts that they have shut down for non-commercial reasons in the last decade?

I would love to see that happen.

Sunak replied:

I know that my right hon. Friend has spoken to the Chancellor about this issue, and that he will continue to have those conversations. In the short term, having consulted on the payment service regulations, we intend to crack down on that practice by toughening the rules around account closures. In the meantime, the Financial Ombudsman Service is available for people to make complaints to, but I look forward to continuing the dialogue with my right hon. Friend, as does the Chancellor.

Later that afternoon in another debate, I saw Labour MP Chris Bryant apologised to Farage for alleging that he had made an enormous amount of money from appearing on Russia Today. I have searched Hansard but cannot find the mention. In any event, Bryant did the right thing. It’s just a pity it took him so long. A quicker apology might have prevented Coutts closing Farage’s accounts.

That evening, Farage discussed the report and said that anyone in trouble with a bank can put in a subject access request for the reasons why. The bank should then respond accordingly, as did Coutts.

Start at the 7:00 mark to watch the discussions, beginning with the subject access request, then moving on to PMQs before moving on to Farage’s guests — hotel magnate Sir Rocco Forte, Conservative MP Danny Kruger and the former MP, left-wing maverick George Galloway, all of whom are on Farage’s side:

Afterwards, Jacob Rees-Mogg had on his panel Kevin Craig, a Labour political adviser, and the former editor of The Sun, Kelvin Mackenzie. The discussion starts at the 24:00 mark:

Rees-Mogg was quick to say that all three are Coutts customers. Rees-Mogg said that he has had his account with the prestigious bank since the age of 13, when he began trading stocks and shares with his father’s permission.

Kevin Craig couldn’t understand what the issue is with Farage, as Coutts offered him an account with parent company NatWest. Rees-Mogg and Kelvin Mackenzie pointed out that offer only came in once Farage made his plight public. Craig still did not accept that Coutts was in the wrong. One of the other two men said that Coutts had been economic with the truth in telling the BBC that the former UKIP leader didn’t have enough funds in his account. (That is also questionable on privacy grounds, I might add.) Mackenzie said that it was likely the head of the NatWest Group, Alison Rose, had to sign off on Farage’s account closures if only because he is so well known. Mackenzie said that Parliament should call Rose before a select committee after summer recess to answer questions about Farage’s case.

Later that evening, The Telegraph published a set of articles about the bank account closures for their Thursday edition.

Coutts issued a statement about account closures:

The statement read: “We recognise the substantial interest in this case. We cannot comment on the detail given our customer confidentiality obligations.

“However, it is not Coutts’ policy to close customer accounts solely on the basis of legally held political and personal views.

“Decisions to close an account are not taken lightly and involve a number of factors including commercial viability, reputational considerations, and legal and regulatory requirements.”

That’s interesting, because The Telegraph told us there had been a number of shady prominent men who had accounts with the bank. Somehow, that posed no problem. In a few cases, hundreds of millions of pounds had been laundered, some of which went through Coutts:

While Coutts closed Nigel Farage’s account because his views did not “align” with their values, other figures linked to the private bank have caused far greater controversy.

Coutts – which describes itself as “inclusive” and “culturally aware” – has previously managed the cash of dictators, mafia bosses, and Russian oligarchs.

The article reveals names, dates and personal reputations of the customers involved, going up to the year 2020.

There might be current Coutts customers with a bad personal reputation today, but, if not, 2020 is an interesting year, because ESG — Environmental, Social and Governance — policies became the main focus of banking (and other) institutions around that time. I covered ESG in my two previous posts, but businessman and former Brexit Party MEP Ben Habib wrote about it in more detail for The Telegraph:

The cancellation of Nigel Farage’s bank account at Coutts is not an isolated incident. It is rapidly coming to light that many from the Brexit side of the debate have been similarly treated – me included.

What perhaps is not yet widely appreciated is how this problem is not restricted to the banking sector. The prejudice which motivated Coutts has infected all regulated businesses. Indeed, it is born out of the regulatory framework. Coutts overstepped the mark, but it was behaving in accordance with regulatory encouragement.

Many commenting on the scandal have asked why the FCA [Financial Conduct Authority] did not step in to ensure Coutts treated all customers equally. The reason is that the FCA is part of the problem.

The virus goes by the name of Environmental Social and Governance (ESG). It is the policy mechanism by which governments across the developed world are requiring public bodies, institutions and businesses to drive towards Net Zero and eliminate social injustice. ESG has now firmly taken its place alongside the traditional drivers of the economy, and in many cases trumped them, including the vitally important profit motive.

The UK’s ESG regime consists of domestic and EU-derived laws and regulations. The sources of legislation are manifold. To name a few, the UK Corporate Governance Code 2018, directors’ duties in the Companies Act 2006, Stock Exchange Listing Rules, the Disclosure Guidance and Transparency Rules, the UK Stewardship Code 2020, the Large and Medium-sized Companies and Groups (Accounts and Reports) Regulations 2008, the Climate Change Act 2008 and the Bribery Act.

All regulated entities, banks being but one, are required to adopt and report on ESG. They are also required to ensure that those entities with which they trade similarly adopt such principles. Directors’ pay is often even linked to the delivery of arbitrary non-monetary ESG goals. So, through this web of laws, regulations, knock on obligations and incentives, ESG has spread into every nook and cranny of the economy.

It is a disaster …

Many businesses have become ESG zealots, favouring its promotion over fulfilling their raison d’etre and the making of money. There are absurd examples of the extremes to which some will go to burnish their credentials …

Someone like Nigel, arguing as he does against membership of the EU or pushing for a debate on Net Zero, for secure borders and the equal treatment of all, no matter their background, presents a threat to ESG and the enormous industry which now exists to promote it. Staff at Coutts would surely have felt virtuous condemning him. The bank must have felt virtuous cancelling his account. It didn’t matter that, in doing so, it robbed itself of a loyal and respectable customer – the sort it needs to fulfil its ultimate economic purpose, making money.

ESG is pernicious. It is everywhere. It is supported by laws and regulations. It is promoted by the Government and regulators. It will not entertain criticism …

Coutts cancelling Nigel’s bank account is a pimple on the tip of a gigantic iceberg.

In a different take, Guto Harri, Boris Johnson’s former Director of Communications in Downing Street, wrote that this would be a ‘PR nightmare’ for Coutts:

After a disastrous anonymous briefing to the BBC from “people familiar with the matter”, which prompted libel threats from Farage, a spokesman said that “the criteria for holding a Coutts account are clear from the bank’s website”. In other words you need to borrow or invest a million or have more than £3m in savings – with the clear subtext that Farage didn’t have it.

Then the bank revealed that Farage’s values did not align with its own:

So what next? Will Coutts now launch an ethical audit of their entire customer base?

Harri found the offer of an account with a sister company, the mainstream NatWest, curious:

The most bizarre twist is that Coutts’ owner NatWest seems willing to accommodate Nigel Farage in the equivalent of its cheap seats.

Whichever genius came up with the idea that offering “alternative banking arrangements… within the wider group”, should prompt every customer too poor to qualify for Coutts to ponder whether they really want to be with an institution that seems to link net worth with moral integrity. Good enough for NatWest. Too xenophobic for Coutts.

He concluded:

A bishop committing adultery is clearly out of order but should I care if my plumber does? Or a footballer? Or even a prime minister? Moral righteousness is surely not the most relevant criteria for the role?

As for Coutts and NatWest, once their PR nightmare is over, executives and directors must ask themselves if they really are in a position to be so self-righteous.

In another article from the paper, former BBC reporter, Jon Sopel, who now works for LBC radio alongside former BBC presenter Emily Maitlis, apologised to Farage:

Jon Sopel, who covered North America for the corporation, said earlier this month Mr Farage “must feel like a bit of a Charlie” after the BBC reported his account was closed for financial, rather than political, reasons.

But after The Telegraph revealed Coutts gave differing “values” as a reason for the account closures, Mr Sopel wrote: “Dear Nigel, [I] always believed when I get things wrong, I own up to it.

“I got it wrong. Sorry. That will teach me to trust reporting of my old employer. If your political views were even part of the reason why account was suspended from Coutts that is totally reprehensible.”

Mr Farage replied: “Jon, Thank you so very much for those words. I fully accept the apology and wish you well. As broadcasters we now have a duty to fight for free speech for our viewers and listeners.”

It will add to pressure on the BBC, which published an exclusive story on July 4 headlined “Nigel Farage bank account shut for falling below wealth limit”, quoting “people familiar with Coutts’ move” and claiming that it had been a “commercial” decision.

On Thursday morning, July 20, Farage spoke to his colleagues at GB News — Andrew Pierce and Bev Turner — as well as to journalist Carole Malone about what he will do next. He said he is considering all options but that his bringing this out into the open is also to highlight that the average Briton can also have his or her bank account closed. This can affect anyone from sole traders who accept cash payments as well as those whose work revolves around digital currencies — the rich as well as the poor.

He also said he was quite upset to find that Coutts had done a media scrape of articles about him over the past several years and compiled them into the 40-page report, making the bank’s decision look political rather than commercial:

Parliament goes into summer recess this afternoon and will not return until September 4.

In the meantime, we shall see if The Telegraph continues to publish more articles about this parlous state of affairs in British banking.

4 comments

July 21, 2023 at 10:01 pm

Bank chief apologises to Farage — but no reinstatement of account | Churchmouse Campanologist

[…] Yesterday’s post provided an update on Nigel Farage’s bank account closure, the 40-page report on him from Coutts and the attention it attracted in Parliament during Rishi Sunak’s PMQs. […]

LikeLike

July 23, 2023 at 6:28 am

john cheshire

CM, Thanks for your response to my previous comment, especially the correction about Yorkshire Building Society.

I’m not sure this Psalm is the most applicable to comment on the wickedness of the Banks and other financial concerns, but it seemed appropriate to me:

Psalm 58

1 Do you rulers indeed speak justly?

Do you judge people with equity?

2 No, in your heart you devise injustice,

and your hands mete out violence on the earth.

3 Even from birth the wicked go astray;

from the womb they are wayward, spreading lies.

4 Their venom is like the venom of a snake,

like that of a cobra that has stopped its ears,

5 that will not heed the tune of the charmer,

however skilful the enchanter may be.

6 Break the teeth in their mouths, O God;

Lord, tear out the fangs of those lions!

7 Let them vanish like water that flows away;

when they draw the bow, let their arrows fall short.

8 May they be like a slug that melts away as it moves along,

like a stillborn child that never sees the sun.

9 Before your pots can feel the heat of the thorns—

whether they be green or dry—the wicked will be swept away.

10 The righteous will be glad when they are avenged,

when they dip their feet in the blood of the wicked.

11 Then people will say,

“Surely the righteous still are rewarded;

surely there is a God who judges the earth.”

regards, John

LikeLiked by 1 person

July 23, 2023 at 11:29 am

churchmouse

Many thanks for posting Psalm 58. Perfect!

Have a blessed Sunday, despite the rain.

LikeLike

July 26, 2023 at 10:01 pm

Victory for Nigel Farage as NatWest chief Dame Alison Rose resigns | Churchmouse Campanologist

[…] to NatWest, his previous one had been to Coutts, which produced the shocking 40-page report, which I covered on July 20. Farage ended by thanking Prime Minister Rishi Sunak and Andrew Griffith MP for their […]

LikeLike