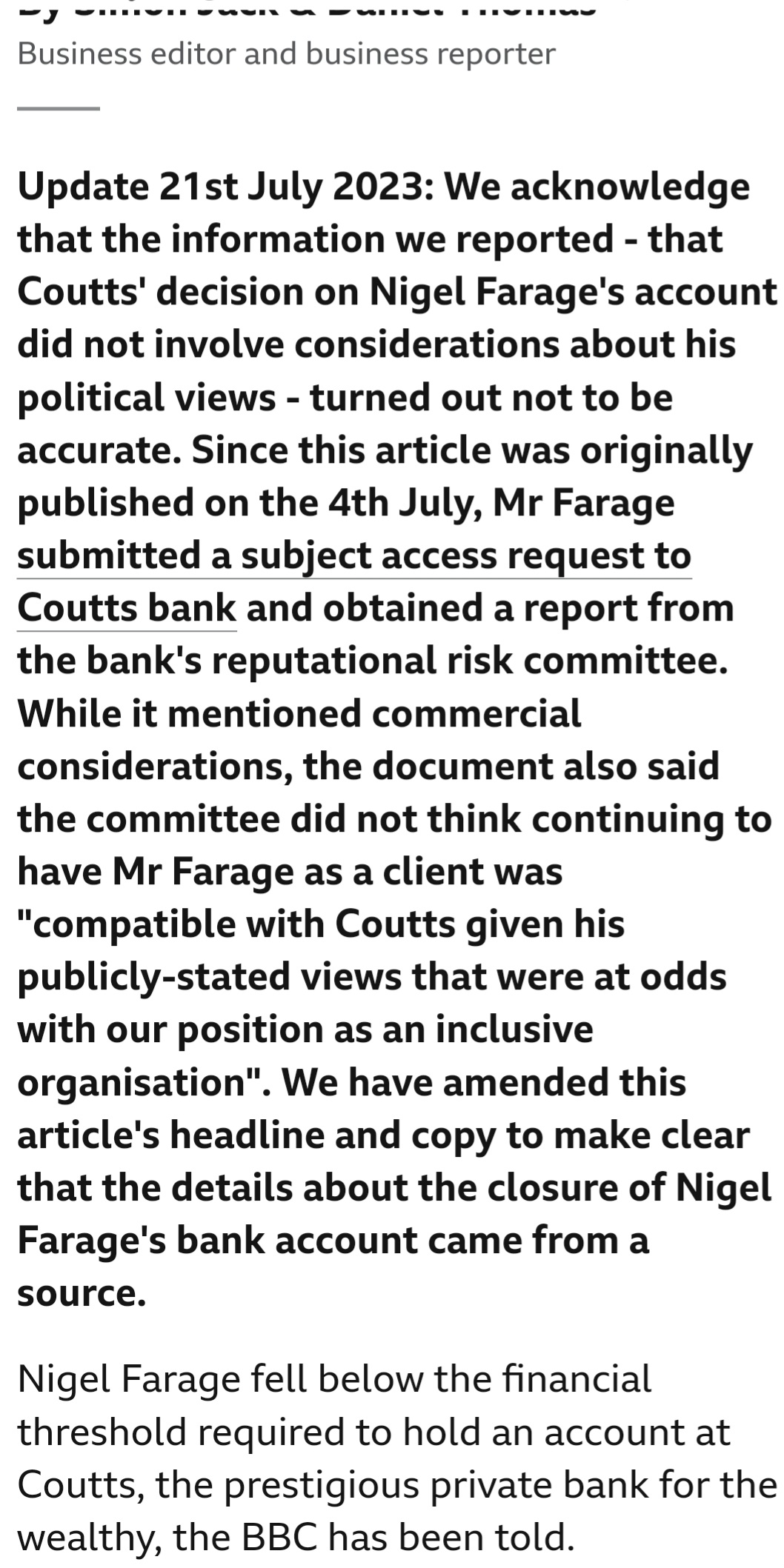

You are currently browsing the tag archive for the ‘Dame Alison Rose’ tag.

More news emerged over the weekend about the state of British banking.

Normally, when Parliament is in recess, there is little news to cover. Traditionally, Britons call this period the ‘silly season’ in the media, full of non-stories.

However, as in 2022, when the Conservative Party leadership race dominated, this summer’s big story is real and gripping: bank account closures.

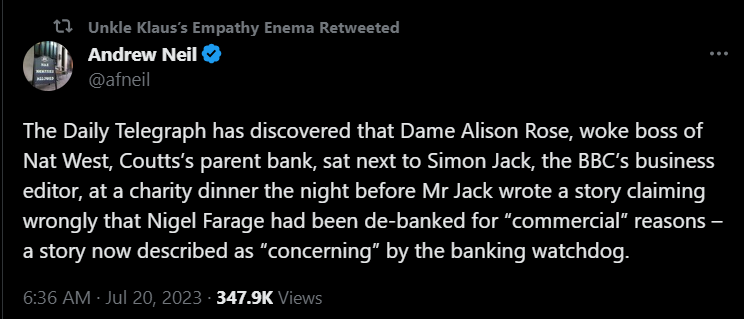

Even The Guardian is reporting on it regularly, despite Labour’s near radio silence, apart from shadow chancellor Rachel Reeves who implied that sacking Dame Alison Rose was tantamount to sexism because she was the first woman at the head of a large financial institution. So what? Rose was wrong; if she were a mere cashier (teller), she would have been sacked for gross misconduct for violating client confidentiality. On the other hand, Lloyd-Russell Moyle MP said he would support Farage in his quest for fairer rules on account closures.

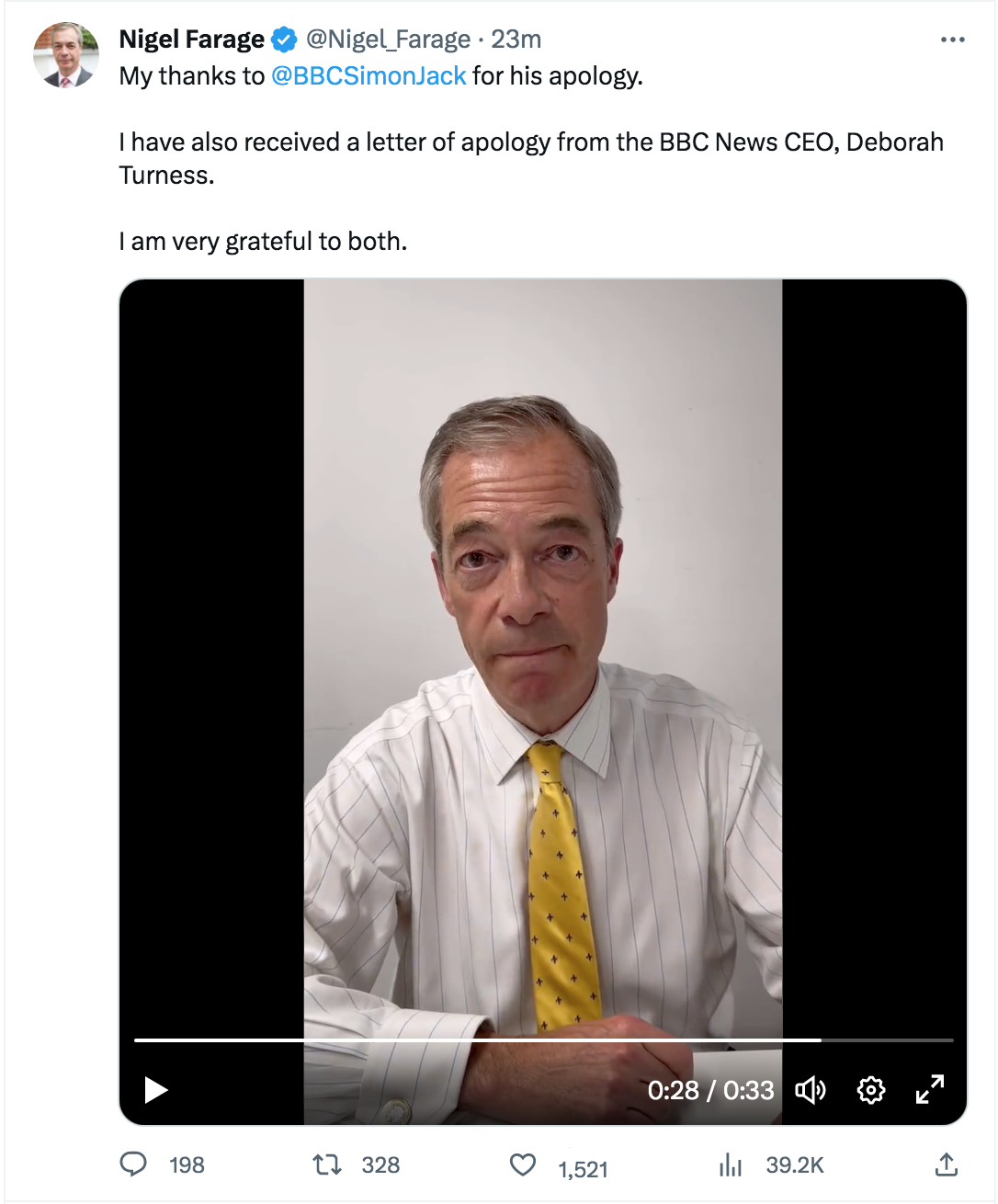

Farage winning

Clearly, Nigel Farage is winning the battle against NatWest and its subsidiary Coutts, his former bank.

At the end of last week, Farage vowed to start a website dedicated to account closures, more about which below.

Last Friday, July 28, 2023, The Guardian reported (emphases mine):

Nigel Farage is used to being thanked by true believers in Brexit, but the man who came to grasp his hand as he sat down for dinner in London’s Belgravia on Tuesday night was a surprise.

“It was a chap who just said ‘Nigel, I’m a remainer, but please, stand up for us’. He was an Italian businessman in London who was having terrible trouble receiving foreign payments because banks thought he was a money launderer,” the former Ukip leader said.

Hours later, the departure of Dame Alison Rose as NatWest’s chief executive over her role in the Farage “debanking” controversy would give the politician turned broadcaster one of his greatest coups since Brexit.

It has also lifted him from the relative obscurity of his last reinvention, as the star anchor of GB News. Just like old times – when he was a near-omnipresent fixture across all channels – he has suddenly found himself back in the limelight with a soapbox issue that has ministers and the rightwing press following in his wake.

He is now launching a website to collect details of tens of thousands of people he expects will back his campaign against a banking system he claims is “rotten to the core”. While he says it will be “non-political, non-party”, the future political potential of such a database is obvious …

His latest campaign, launched on 30 June in a tweeted video that claimed his accounts with a “prestigious” bank had been closed without explanation, was different. The details were sparingly teased out in tweets and videos before NatWest-owned Coutts was confirmed as the bank in question.

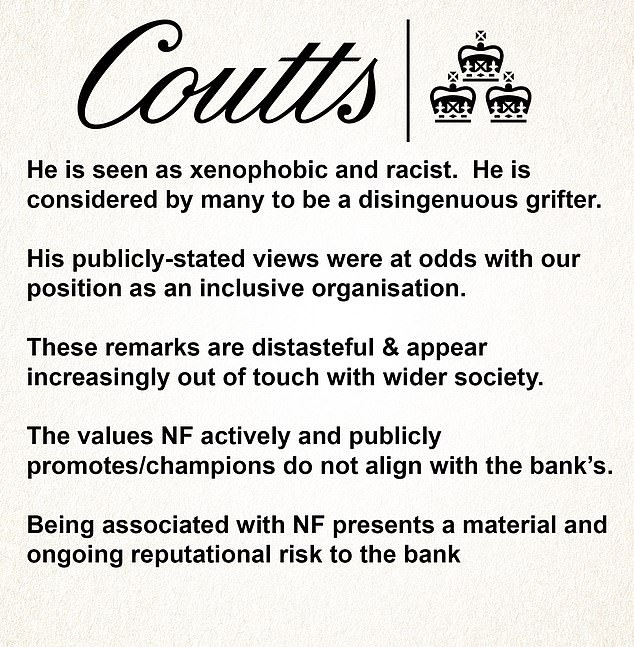

By the time Farage revealed, via a subject access request, that Coutts had compiled a secret 40-page dossier accusing him of being a “disingenuous grifter” who promoted “xenophobic, chauvinistic and racist views”, it had turned into a monumental PR disaster for the bank.

Lloyd Russell-Moyle, a Labour MP who went on Farage’s GB News show on Wednesday night to talk about his own banking struggles as a “politically exposed person”, said: “He has tapped into something here which I think the liberal elite in my own party and in the media have misunderstood, and that is how the banks have treated some people appallingly and how they continue to operate.

“What Farage has done this time is take something that is a privileged, niche problem for him and then really build on it in terms of how the public are treated. It’s effective politics.”

Yet while Russell-Moyle does not view Farage’s banking campaign as a “culture war” issue, close watchers of Farage and various incarnations of Britain’s populist right and far right remain wary.

Joe Mulhall, the director of research at the anti-racism campaign group Hope Not Hate, said Farage had clearly been “looking round” since Brexit for a new issue, adding: “He hasn’t been this relevant for years.”

He added: “For a period he was the keeper of the Brexit flame but … its salience has dissipated so he has been looking for an alternative and seems to have found one that paradoxically makes him a crusader for the ‘working man’ and small businesses wronged by an elite.”

That may be, but Farage has been telling us about his full inbox for weeks now, so he has struck a genuine chord with the British public.

It surprises me that Hope Not Hate would shy away from joining Farage’s campaign in principle. Enough said about them.

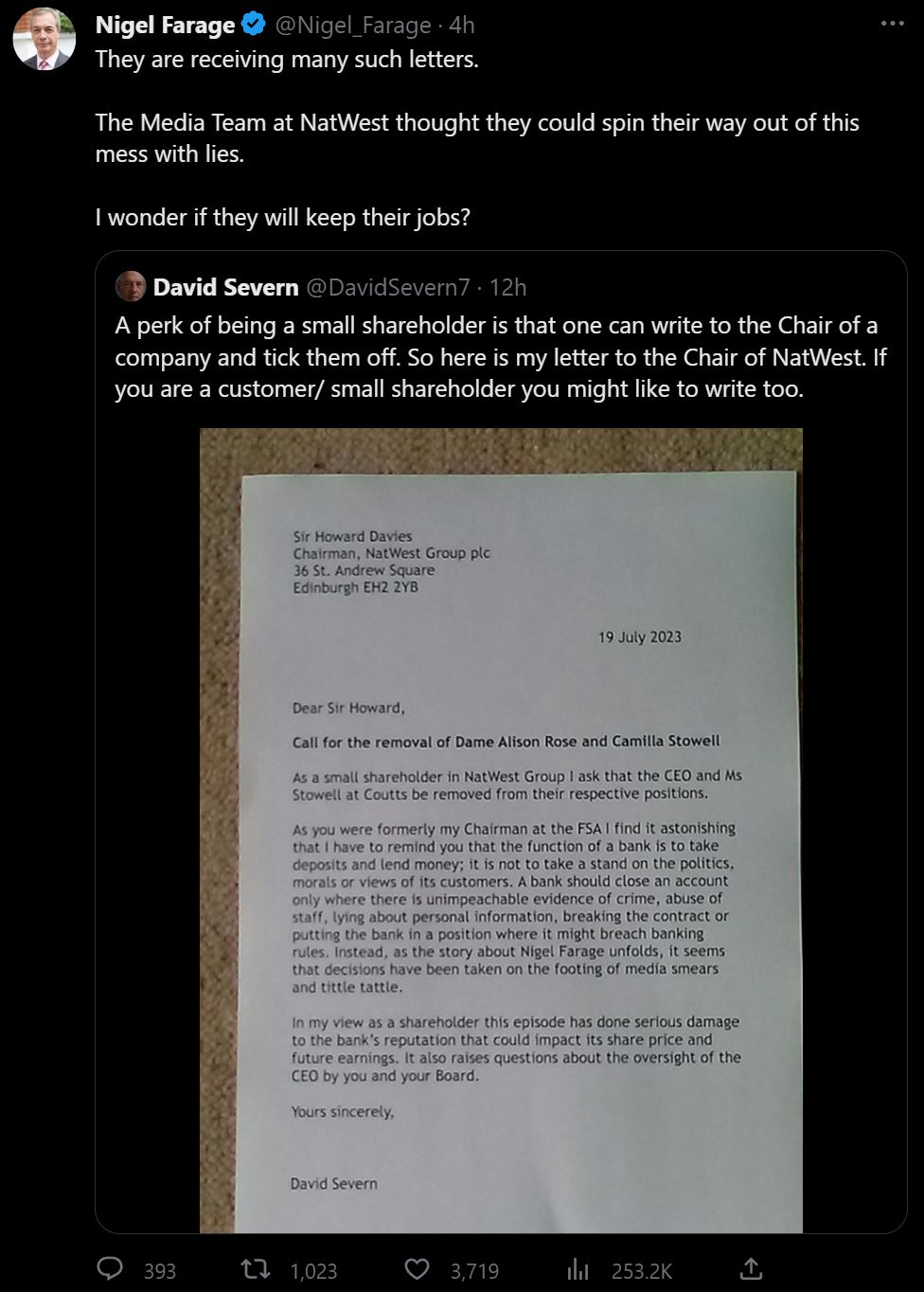

Early on Sunday, July 30, the paper reported on the imminent website, which appeared shortly afterwards, and on how unpopular NatWest’s chairman Sir Howard Davies is among Conservative MPs:

The former Ukip leader is to spearhead a website assisting anyone who wants to find out why they have been denied a bank account. Farage used a subject access request to discover that, despite initial denials by Coutts, his political views had played a part in the closure of his account.

Farage is said to want to make the independent website a non-partisan tool designed to help those who believe they have been denied banking services because of their political views. It will provide them with a step-by-step guide to demanding the personal information a bank holds about them.

While NatWest, which owns Coutts, is said to have faced hundreds rather than thousands, of similar requests so far, Farage and his supporters believe the new website will help those daunted by the process of questioning their bank.

“This is cross-party, it is non-partisan,” said an ally. “Dare I say, how the liberal elite – for want of a better term – have managed to turn Nigel Farage into one of the country’s leading consumer champions, I have no idea.”

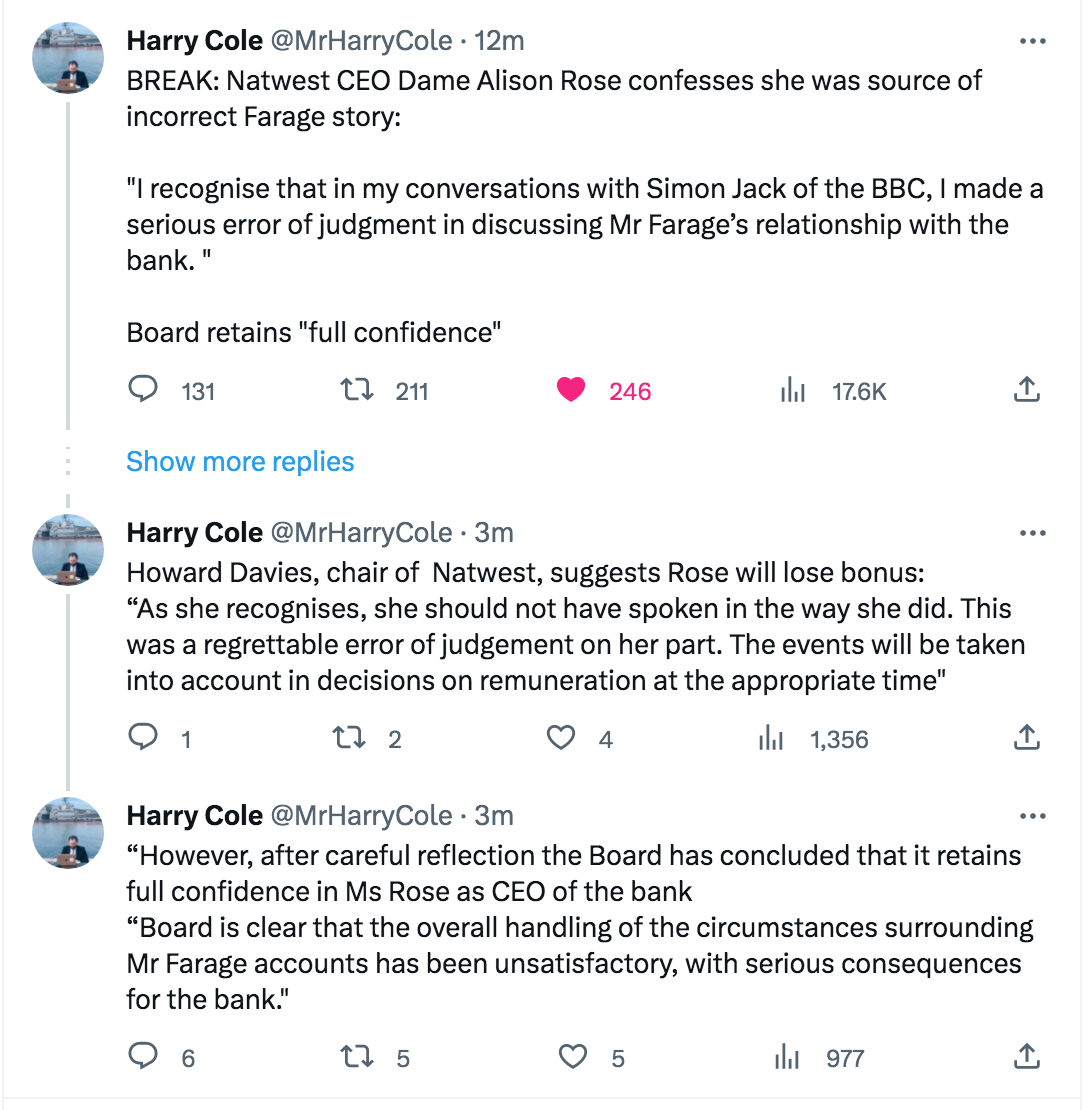

There has already been a huge fallout from Farage’s case. Dame Alison Rose, the chief executive of NatWest Group, eventually stood down in the wake of the row after she revealed she had been the source of a BBC story claiming Farage’s account had been closed for commercial reasons.

She was soon followed out of the door by Peter Flavel, chief executive of Coutts. Farage also wants NatWest Group’s chairman, Howard Davies, to stand aside.

While Downing Street made clear that Rose could not stay in her post, the government appears to be more protective of Davies. Andrew Griffith, the City minister, said on Friday night that it would not be “helpful” for the NatWest Group’s chairman to quit.

However, Davies is already unpopular with some on the Tory right. He unleashed a stinging criticism of Liz Truss and Kwasi Kwarteng’s disastrous mini-budget in front of hundreds of his staff last year. He explained how he felt “embarrassed” in its aftermath while attending a conference for the International Monetary Fund, the Washington-based lender of last resort.

Farage’s new website is AccountClosed.org, at the bottom of which says:

… Account Closed, a campaign group for individuals and small medium businesses who have been unfairly treated by bank and financial services companies.

The website has a short survey about whether one agrees with current banking practices concerning account closures. Entering one’s email is optional at the bottom of the home page.

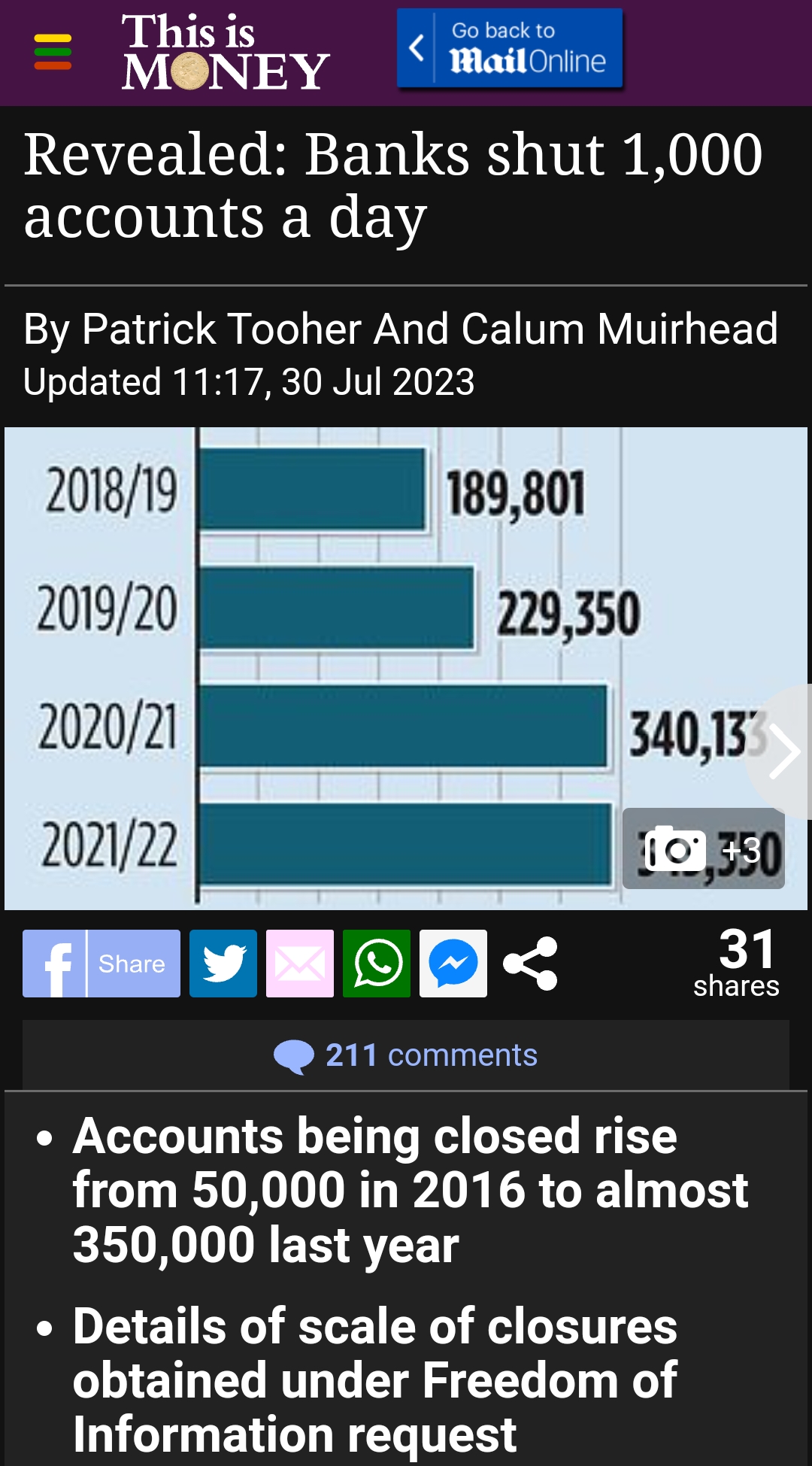

This is a huge issue, as over 1,000 British bank accounts are closed every day. Farage rightly says that this is ruining the lives of many, especially small businessmen and women. The shocking statistic was a headline not only at GB News but also The Mail and The Guardian:

On Sunday evening, GB News’s Mark Dolan interviewed Howard Brown, who was the face of the Halifax for several years in television adverts. He had customer-facing and marketing jobs with the bank. He said he was astounded to hear of account closures en masse and said it never occurred when he was in banking. He said the situation is ‘saddening’:

On Monday evening, July 31, Farage opened his GB News show by mentioning the website and had an update on his closed Coutts account:

The Guardian reported that, in his editorial, he said, in part:

Nigel Farage has said that the newly installed boss of Coutts has offered to keep his accounts there open, reversing a decision that triggered a scandal and the resignation of the private bank’s previous chief executive.

The former Ukip leader said he welcomed the offer but was still taking legal action against NatWest, which owns Coutts, demanding compensation, a full apology and a face-to-face meeting with the banking group’s bosses.

Peter Flavel resigned as Coutts chief executive last Thursday, less than two days after the NatWest boss, Alison Rose, also stepped down over her role in the row. Flavel has been replaced by Mohammed Syed.

“The new CEO of Coutts … has written to me to say I can keep both my personal and my business accounts, and that’s good, and I thank him for it,” Farage said on GB News on Monday night.

“But enormous harm has been done to me over the course of the last few months … It has taken up a huge amount of my time and it has cost me, so far, quite a lot of money in legal fees. So I have today sent a legal litigation letter to Coutts, where I want some full apologies, I want some compensation for my cost.

“But more important than all of that, I want a face-to-face meeting with the bank’s bosses. I want to find out how many other people in Coutts or NatWest have had accounts closed because of their political opinions. And I want to make sure this never happens to anybody else ever again” …

Farage did not clarify whether he had accepted Coutts’s offer to keep his account open. NatWest Group said it could not comment on individual customers.

Good!

The article continues:

His comments came hours after the City regulator urged NatWest shareholders, including the UK government, to “choose stability”, suggesting they should resist calls for the group’s chair, Howard Davies, to resign over the ballooning scandal linked to Farage’s accounts …

Farage wants more heads to roll at NatWest – which is still 38.5% government-owned after its 2008 state bailout – but on Monday the Financial Conduct Authority (FCA) called for calm.

“The economic secretary to the Treasury [Andrew Griffith] just last week mentioned that he had confidence in Howard Davies, the current chair,” the FCA’s director for consumer matters and competition, Sheldon Mills, said. “I agree with his view that it’s important to have stability at NatWest and that having a chair remain in place will help support that.”

Later, on Dan Wootton’s GB News show, Farage said that Travers Smith, the law firm conducting the review of Farage’s account closures as well as those of others over the past 24 months, had spoken out against Brexit some years ago:

Wootton’s opening editorial was about the bank account closures and Farage’s new website. Afterwards, a panel discussion took place with journalist Carole Malone, Boris’s father Stanley Johnson and Conservative MP Dame Andrea Jenkyns. Jenkyns repeated what she had said the previous Thursday on the show: that her bank account had been closed and she has had problems opening another one. Before that and the editorial (around the 11:00 minute mark), the last news item was about a group of Conservative MPs, one of whom is Iain Duncan Smith, who wrote to the Financial Conduct Authority (FCA) to say that action must be taken against banks closing accounts where customer perspectives do not agree with the banks’:

On Tuesday evening, August 1, Farage interviewed mega multi-millionaire Arron Banks, who was co-founder of the Leave.EU campaign prior to the June 2016 Brexit referendum. He was also a major donor to UKIP and, before that, to the Conservative Party. He owns several businesses in the UK. He had been accused of having close ties to Russia. The story grew and grew. A Guardian journalist published accusations with no concrete evidence; a lawsuit concluded only recently, and she has to pay him damages for defamation.

Because of all this, he had his business bank accounts closed, which he said was a period he said was devastating personally and professionally. Farage asked him why he did not speak out. Banks explained that any businessperson who does will find themselves blacklisted with other financial institutions. A parlous state of affairs:

Bank account closures: what to do

On Monday, August 1, The Telegraph posted ‘Are you at risk of having your bank account closed?’

The article gives the reasons why banks may decide to close accounts. Excerpts follow:

If you are related to, or associated with, a politician or high-profile person there is a fair chance banks will be investigating you, and may decide to close your account.

… you can have your account closed if the bank thinks you are a reputational risk and have differing opinions to its values – which Mr Farage claims were the reasons for Coutts closed his account.

… members of the public who know or associate with high-profile people can also find themselves de-banked, even if they aren’t in the public eye.

This is because banks and other financial institutions are required to apply enhanced due diligence to politically exposed individuals – and people associated with them – to ensure that they are not using their institution for money laundering or accepting cash from illegal sources.

The Financial Conduct Authority (FCA) is currently reviewing the rules for politically exposed people, and is set to report back on any changes later this year.

If you have moved to the UK from another country and regularly receive money from abroad – be it from friends or family, or a business – banks may decide to freeze or close your account.

The same could happen if you consistently send large sums of money to overseas accounts …

Banks can be very cautious when dealing with cryptocurrency which, according to recent FCA data, is becoming increasingly popular with younger people.

Cryptocurrencies are unregulated, and as many of the companies that offer this form of currency are based outside of the UK, moving crypto through your account could raise red flags at your bank.

Surprisingly, the same thing can happen when it comes to gambling. There have been claims people have had their accounts shut after receiving deposits of their winnings.

There may be instances where customers are asked to bank elsewhere if their accounts simply are barely used.

Banks have measures in place for converting bank accounts into dormant accounts when they are unused and unable to contact customers for a certain period of time …

Customers should feel empowered to make complaints to their bank when they are unhappy with their service, as long as communications are respectful. Some banks can close an account if a customer is abusive to its staff, either over the phone or in a branch.

While serious issues such as suspected criminal activity should result in the closure of an account, the Treasury and FCA announced they are working on rules to stop bank account closures from happening as frequently …

However, banks are private institutions and, even with the rule changes, can still close a person’s account for various reasons stated above. If the new legislation comes into force, they’ll just have to give you three months’ notice.

I would clarify that last paragraph by saying that the Government — taxpayer, really — still owns 39% of NatWest after the banking crash of 2008. As such, the banking group is not entirely a private institution.

The Telegraph has a helpful article on filing a subject access request — SAR — with one’s bank in the case of frozen or closed accounts: ‘Find out what your bank thinks about you’:

Under the General Data Protection Regulation 2018, everyone has the right to ask an organisation, including a bank, whether or not they are using or storing their personal information.

You can also ask them for copies of your personal information, verbally over the phone or in branch or in writing, through a “right of access” – otherwise known as a SAR.

You can make a SAR request if you want to find out more about what personal information a bank holds about you, how they are using it, who they are sharing it with, and where they got your data from.

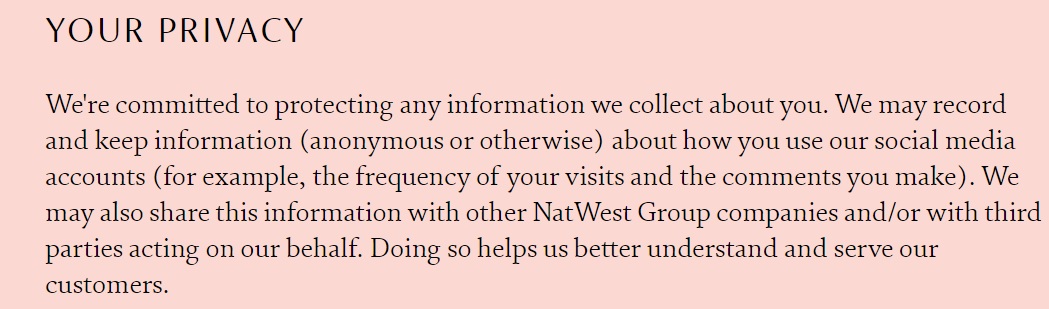

A notice on NatWest’s website states that you should be specific in your submission regarding the information you want to obtain from the bank.

This includes whether you want or need a certain call recording with the bank or a copy of a document.

Essentially, the more information you provide in your SAR the easier it will be for your bank to find it in its system and reply promptly.

If you and a joint account holder want to see the information held in that account, both parties should complete and sign a SAR form. One copy of the information held on the account will be issued for the attention of both parties.

After a SAR is submitted your bank will typically respond to your request within 30 days, but more complex requests can take up to 90 days.

A bank will send your information back in PDF form to a verified online bank account, email or via post to a confirmed address.

Disagreement about Sir Howard Davies

Not everyone is so enamoured of NatWest chairman Sir Howard Davies or keen to see him stay on.

On Friday, July 28, The Telegraph‘s chief City commentator Ben Marlow put forward the case against him in ‘NatWest can’t move on with Sir Howard Davies in charge’:

… After the tsunami of criticism that has engulfed the company and the resulting vacuum it has left at the top, some level of reassurance and calm was probably needed. But a “business as usual” approach from those that remain in the boardroom also speaks to the problems at the heart of the organisation.

Interim chief Paul Thwaite says he is “determined we…start to move forward quickly” but the idea that NatWest can do that with Sir Howard still overseeing affairs is desperately naive and suggests the penny still hasn’t dropped at NatWest HQ. Sir Howard has “reflected” on his position and decided – shock horror – that he shouldn’t have to go too.

He should do the honourable thing and step aside now. Having almost fulfilled his full nine-year term anyway and with a search already underway for a successor, what’s the point in hanging around?

Sir Howard says it’s about ensuring stability but I would argue it does the opposite by prolonging the uncertainty and making it impossible to draw a line under the crisis. And what message does it send about how serious the bank is about overhauling its rotten culture, which is what now has to happen?

Sir Howard has already proven that he’s the wrong person to lead any sort of post-mortem into this catastrophic act of self-harm with the risible way in which the board responded throughout, or rather didn’t – at least initially.

Marlow brought a new person into the mix, Lord Remnant, who is the chairman of Coutts:

The 72 year-old [Davies] and his Coutts counterpart Lord Remnant are esteemed City grandees with vast experience of operating at the very highest level of the financial sector.

Sir Howard has worked at the Treasury, been the deputy governor of the Bank of England, and has previously led the predecessor to the Financial Conduct Authority. Remnant was a senior investment banker at Credit Suisse, has been director of the Takeover Panel on two occasions, and was on the board of Northern Rock [which went bust in the 2008 UK banking crash], though a cynic might point to the existence of one or two sizeable red flags in that CV.

Yet, in the face of what is the biggest crisis the bank has faced since the financial crash, the pair have been conspicuous almost entirely by their silence.

Sir Howard kept his head down only until it was obvious that he couldn’t any longer. Yet when his intervention came, he fluffed his lines spectacularly by allowing Rose to issue a nonsensical apology and stay in post.

As the saying goes: “you had one job”. Hours later she was gone – the result of a humiliating dead-of-night intervention by the twin forces of Number Ten and the Treasury no less.

Meanwhile, there hasn’t been a peep from Remnant despite the departure of Flavel 24 hours later. Governance doesn’t come much more meek than this.

Perhaps Sir Howard is hoping that a giant shareholder bung in the form of £500m of dividends and a £500m buyback, £190m of which will go to His Majesty’s government as the bank’s largest shareholder, will buy him some time.

One assumes he has the backing of ministers for now at least but the idea he can hang around until next year, as planned, is plainly nonsense. At the very least, his exit will surely be accelerated by six months …

I hope so.

Lord Remnant

Not having heard of him, I had to look up Lord Remnant.

Philip John Remnant, 68, is the 4th Baron Remnant and a hereditary peer. In a July 2022 House of Lords by-election for hereditary peers, he was elected to replace Lord Brabazon of Tara after his retirement in April that year. Both are Conservatives.

Last Thursday, July 27, The Mail told us much more, although they left out his time at Northern Rock:

Tory peer Lord Remnant took over as Coutts chairman in January after a string of roles in finance and business.

The ‘lifelong Conservative’ was voted into the House of Lords last July, having promised in his candidate statement to ‘commit enthusiastically to the Lords’ after ‘reducing business interests’.

A few months later he was appointed Chairman of Coutts, with NatWest chairman Sir Howard Davies announcing him as an ‘excellent addition’ who would ‘add immense value to guide and inform Coutts business priorities going forward.’

In a speech on the Trophy Hunting bill, Lord Remnant described his ‘natural habitat’ as the ‘financial services jungle’.

He had recently stepped down from water company Severn Trent plc after nine years on the board and retired from the Takeover Panel after 10 years as deputy chair.

Previously, he was Chairman of the City of London Investment Trust plc and of M&G Group Limited.

In his maiden speech in the Lords he said: ‘I followed my father into the City, as a chartered accountant and then an investment banker.

‘Since then, I have sat on the boards of major listed financial services companies and so have long been subject to the rules of our financial regulators.’

Born in 1954, with two brothers and a sister, he attended Saint Ronan’s School in Hawkshurst, Kent – the same school as his father, the previous Lord Remnant.

The article also gives us more information on Peter Flavel:

Australian-born banker, Coutts chief executive Peter Flavel, took the helm in 2016 after working for Standard Chartered’s Private Bank and JP Morgan.

Born to pub-owing parents, he studied law, economics and commerce at university near his childhood home in Adelaide and Melbourne – he has also attended the Advanced Management Programme at both Harvard Business School and the University of Oxford – before taking a job at National Australia Bank.

In 2006, he moved to Singapore to run Standard Chartered’s Private Bank, then switched to JP Morgan’s wealth management arm.

Last year, there were increasing signs that Mr Flavel, who turned 63 on Tuesday, was becoming increasingly enamoured with issues such as inclusivity and climate change.

The executive shared posts about ‘benefitting the environment and people of all identities and backgrounds.’

‘Each and every one of us has the power to create change,’ he says on the bank’s website.

In an interview in 2019, he revealed he was an adherent to working from home before it became the norm, saying he liked to do so once a month at his West London flat, which the father-of-three shared with wife Ally.

‘Sitting there on our little balcony overlooking the garden fills you with so many new ideas,’ he said.

I bet it does.

No doubt he had a cheery lockdown period during the pandemic, while others, without the privilege of a back garden or a balcony, were told to stay at home, without even so much as a walk to a park.

Why banks are closing accounts

Anti-money laundering laws in the UK are very strict and banks spend a lot of money monitoring certain accounts. If memory serves me correctly, they spend £150 for every £1 they discover is laundered. Therefore, it is much cheaper to close suspected accounts than to keep them open.

Ironically, it was NatWest which was responsible for a landmark case involving money laundering.

On December 13, 2021, the BBC reported:

NatWest has been fined £265m after admitting it failed to prevent money-laundering of nearly £400m by one firm.

A gold trading business suspected of money-laundering deposited £700,000 in cash into one NatWest branch in black bin bags, a court heard on Monday.

A criminal gang deposited huge sums of cash across about 50 branches, prosecutors for the UK’s financial watchdog said.

NatWest said it deeply regrets failing to monitor the customer properly.

It is the first time a financial institution has faced criminal prosecution by the Financial Conduct Authority (FCA) under anti-money laundering laws in the UK.

The fine would have been much higher, but it was reduced because the bank had pleaded guilty, the judge said at the sentencing hearing …

The bank’s chief executive Alison Rose said: “NatWest takes its responsibility to prevent and detect financial crime extremely seriously.

“We deeply regret that we failed to adequately monitor one of our customers between 2012 and 2016 for the purpose of preventing money-laundering.”

How this happened beggars belief. It would make a great movie:

Bradford jewellers Fowler Oldfield’s predicted annual turnover when taken on as a client by NatWest was £15m. But it deposited about £365m over five years, including £264m in cash.

The company, which was shut down following a police raid in 2016, was initially marked as “high-risk”, but that was downgraded in December 2013.

The FCA’s lawyer Clare Montgomery said there “was a rapid escalation in the amount of cash” being deposited from November 2013, with figures reaching up to £1.8m a day. By 2014, Fowler Oldfield was NatWest’s “single most lucrative” client in the Bradford area.

Southall received about £42m in cash between January 2015 and March 2016, for example, but no report was made that it was suspicious.

That is despite lawyers saying earlier on Monday that one person in Walsall arrived at a branch with so much cash, packed in bin-liners, that they broke and the money had to be repacked.

Ms Montgomery added that the cash did not even fit in the branch’s floor-to-ceiling safes.

NatWest did not properly look into numerous warnings generated by its systems, the FCA lawyer said earlier on Monday.

One rule designed to flag suspicious activity was disabled by the bank because it created too many alerts, “so the bank decided it should be deactivated”, Ms Montgomery added, while NatWest also recorded cash deposits by Fowler Oldfield as cheques between 2008 and March 2017.

The National Crime Agency also raised concerns at one point because of the high number of Scottish banknotes being deposited in England, the court heard.

And a NatWest cash centre in north-eastern England raised queries about Scottish banknotes, saying that they had a “musty smell”, suggesting they might have been stored rather than in normal circulation.

The state-backed bank was “in no way complicit in the money-laundering which took place”, the judge said at Southwark Crown Court on Monday.

But they added: “Without the bank’s failings, the money could not have been laundered.”

Sara George, partner at Sidley and a former prosecutor for the Financial Services Authority, told the BBC that it was clear there were failings at every level.

“It’s hard to imagine a much more clear indication of criminal proceeds than black bin-liners of money. It’s extraordinary,” she said.

She added that the “landmark” case showed that the UK’s financial watchdog was “committed to using a fuller spread of its enforcement powers” to stop money-laundering, which she described as “anything but a victimless crime”.

Luckily for Alison Rose, ESG saved her — until Coutts closed Farage’s accounts.

The Telegraph explains in ‘How Britain turned against self-righteous bosses’:

Dame Alison Rose had a spring in her step as she greeted NatWest staff and shareholders in April [2023].

Speaking at an annual gathering at the bank’s sprawling headquarters on the outskirts of Edinburgh, the chief executive had recently received one of the highest awards in the King’s first honours list.

She was also the first NatWest boss to get an annual bonus since the financial crisis.

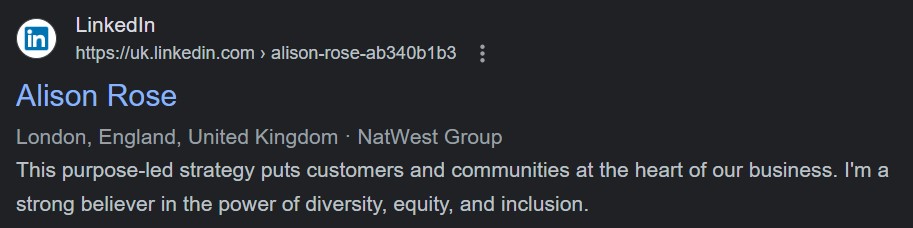

Since winning the top job in 2019, Dame Alison had been feted not just for her banking nous but for championing corporate “values” and “purpose”, buzzwords embraced heartily by fellow blue chip executives.

“Our values are at the heart of how we deliver our purpose-led strategy,” she told the gathering.

Under her leadership, NatWest had come to describe itself as “a relationship bank for a digital world”. Its values are “being inclusive, curious, robust, sustainable and ambitious”.

They are laudable aims. Yet these same values would be Dame Alison’s undoing, as they were applied in ways she may never have imagined.

In a now widely reported dossier first revealed by The Telegraph, overzealous employees at Coutts, a private bank and subsidiary of NatWest, explained at length why they believed the group’s inclusion or “ESG” (environmental, social and governance) policies meant they should no longer provide services to Nigel Farage …

It is a fiasco that has thrust corporate values and so-called “woke capitalism” into the spotlight, underlining the risks companies can expose themselves to when they wade into politics and social causes …

… the birth of the modern ESG movement has been credited to a paper published by the United Nations in 2004. “Who Cares, Wins” claimed that companies applying these principles were not just doing the right thing but also made themselves more competitive.

The ideas have gained traction in the C-suite ever since, as big businesses seek to downplay the “greed is good” culture that critics blamed for the financial crisis.

Perhaps no British bank embodied this transformation as much as NatWest, previously known as Royal Bank of Scotland.

Under former chief executive Fred “the Shred” Goodwin – dubbed “Britain’s most notorious banker” – RBS embarked on a global takeover spree, briefly making it the world’s biggest bank before it crashed spectacularly. It was bailed out in 2008 to the tune of £46bn in taxpayer cash, and Goodwin became a lightning rod for public anger.

By contrast, Dame Alison’s public image could not have been further from Goodwin’s. A bank lifer who joined as a trainee, she spent years patiently climbing the corporate ladder and, later, cleaning up the disgraced investment banking division of RBS.

When she succeeded Ross McEwan as chief executive a year later, she immediately set about replacing the RBS brand with the less toxic NatWest one, while launching a company-wide process to find the lender’s “purpose”.

“I truly believe that if you are going to lead an organisation and create an organisation that has value over the long-term, it has to be purpose-led,” she told the Blueprint for Better Business podcast last month …

But as the ESG movement has grown, and a cottage industry of consultants, spinners and auditors have sprung up around it, so too have the risks of companies getting things wrong.

How true. In other words, ‘go woke, go broke’. The article has several other examples, from Unilever to Mars confectionery.

The view from Ireland

And, finally, we have an expression of gratitude from Ireland for Nigel Farage’s heroic efforts in the bank account closure debacle from Gript‘s John McGuirk:

… he has been unwilling to make any compromises in order to be liked by the sort of people who despise the things he believes in. In this case, for example, the easier thing would undoubtedly have been to say nothing and find a new bank – but by refusing to go quietly, it has ended up being the Natwest CEO, Dame Alison Rose, who needs to find herself a new bank.

And the Farage row has won a victory not only for himself, but for others: Because if they can’t do it to Nigel Farage, the architect of Brexit and just about everything else that people like Fintan O’Toole consider to be pestilent, then it has become much harder to do it to any of the rest of us.

There is no doubt in my mind, for example, that had they gotten away with doing what they did to Nigel Farage, then just about anyone prominent who stubbornly hangs onto the view that men and women are born, not assigned, would have found themselves without a bank in short order. The same would be true of anyone in Ireland prominently associated with protests about immigration.

That, after all, is how society works now: The ruling liberal order is maintained through a strict regime of incentives and punishments. If you want to keep your job and your nice life, keep your mouth shut.

We owe Farage for challenging that, and preserving the very essence of what it is supposed to be to live in a free society: The right to say loudly and proudly, without fear of punishment, that the people who are ruling your country are buffoons …

Farage has always been hated precisely because he punctures that and appeals to something more enduring: The common wisdom of the ordinary person who knows that what they are hearing is nonsense, but lacks the confidence to argue with “experts agree”. That, above all, is why they hate him, and why they try to shut him up at every opportunity.

It is also why, as in this case, he keeps winning. Lest this sound like an homage, there are many things this writer differs from Farage on – Brexit being just one. But in Farage versus Natwest, as in so many things before, he has once again shown that his existence is something for which every true democrat should be thankful.

If they’d gotten away with doing this to him, the rest of us were next in line.

Well said!

I will be moving on to other topics this week, so I hope this will be the last banking post for a while.

My ongoing series on Nigel Farage’s bank account debacle continues.

Congratulations to him, because not only did Dame Alison Rose resign as the head of NatWest, but the head of their subsidiary Coutts, Peter Flavel, resigned on Thursday, July 27, 2023.

I wrote about Dame Alison Rose’s resignation yesterday. Paul Thwaite has replaced her as interim NatWest CEO.

Little did I know that more news would follow that afternoon.

Peter Flavel resigns

Yesterday, I wrote:

The Times‘s view — the main editorial — also points the finger at Coutts’s chief Peter Flavel, who has managed to keep an exceedingly low profile throughout all of this …

As usual, Guido Fawkes beat many in the mainstream media in giving us breaking news.

At 14:11 on Thursday, he posted ‘Coutts CEO Peter Flavel Resigns’ (red emphases his):

Coutts chief executive Peter Flavel has resigned, less than 48 hours after his boss Alison Rose also quit for briefing false information – and breaching client confidentiality – to the BBC about Nigel Farage’s finances. He announced the inevitable this afternoon:

In the handling of Mr Farage’s case we have fallen below the bank’s high standards of personal service. As CEO of Coutts it is right that I bear ultimate responsibility for this, which is why I am stepping down.

Another scalp for Nigel…

Guido later posted Farage’s tweet at the news:

Guido ended his post with this:

NatWest Group chairman Howard Davies is still clinging to his job. For now…

More on Sir Howard Davies below.

At 2:15, The Telegraph published ‘Coutts chief steps down over Nigel Farage de-banking scandal’ (purple emphases mine):

Peter Flavel, who became boss of Coutts in 2016, said the treatment of Mr Farage had “fallen below the bank’s high standards of personal service.”

Paul Thwaite, the interim chief executive of NatWest, which owns Coutts, said: “I have agreed with Peter Flavel that he will step down as Coutts CEO and CEO of our Wealth Businesses by mutual consent with immediate effect.

“Whilst I will be personally sorry to lose Peter as a colleague, I believe this is the right decision for Coutts and the wider group” …

Mr Flavel said: “I am exceptionally proud of my seven years at Coutts and I want to thank the team that have built it into such a high performing business. In the handling of Mr Farage’s case we have fallen below the bank’s high standards of personal service. As CEO of Coutts it is right that I bear ultimate responsibility for this, which is why I am stepping down.”

His column inches are so short because he lay below the radar the whole time. Yes, he should have responded to Nigel Farage about his account closure. However cowardly his behaviour was though, he is the sort of man who believes that discretion is the better part of valour. No doubt he will get a nice payoff and be off to equally sunny climes in his career sooner rather than later. I’m not saying that in support of him, but discretion and integrity are important in life. It’s a pity he lacked integrity.

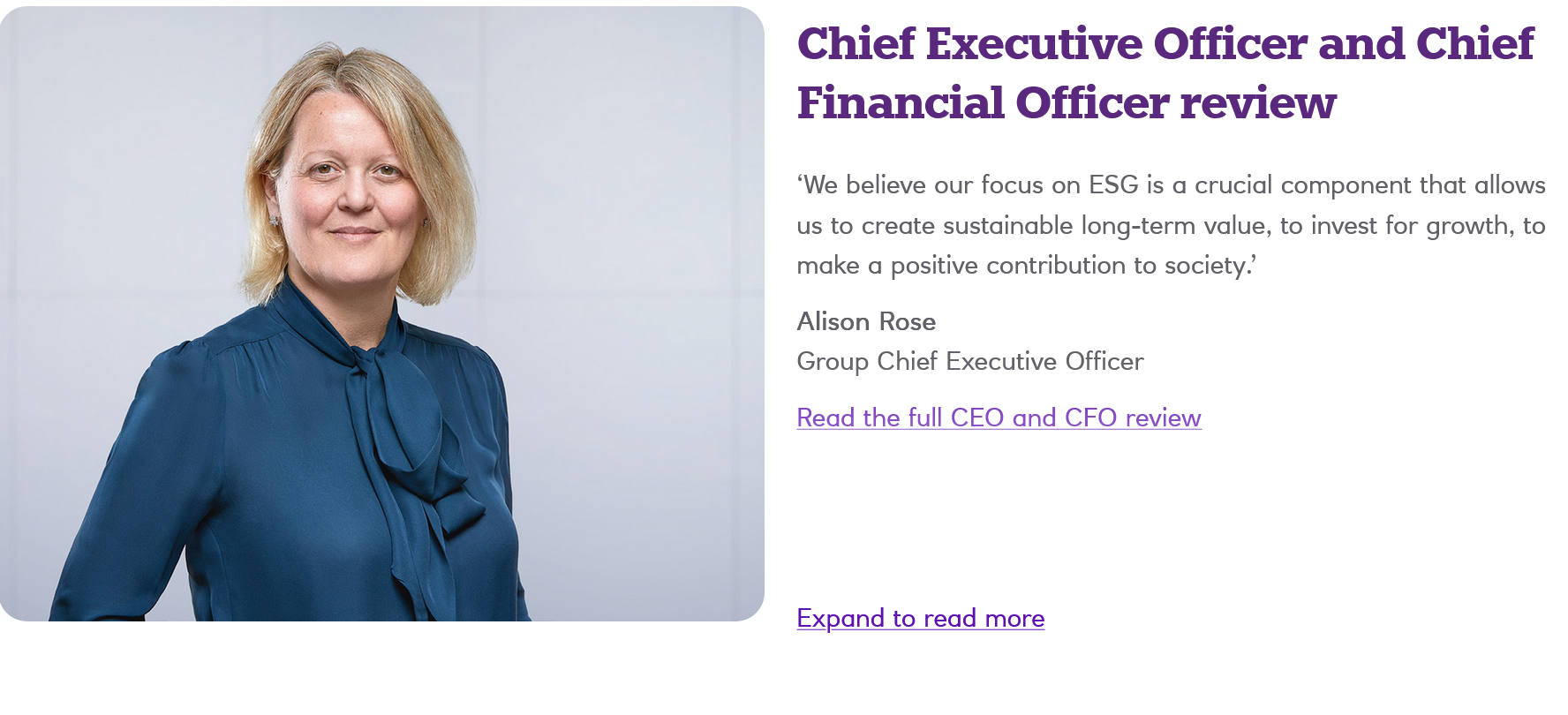

Note that NatWest’s first rule is to act with integrity. It’s a shame the person who posted this screenshot did not highlight the fourth point:

GB News reaction

On Thursday evening, GB News had several fascinating discussions on the Farage farrago.

On Dewbs & Co, Michelle Dewberry had as her panel Lord Moylan and historian David Starkey. Talk about a dream team. A woman even emailed Michelle to say how much she enjoyed listening to the two men:

They discussed Farage and NatWest in the opening segment, which begins at the 6:03 mark. Starkey criticised people like ex-BBC presenter Emily Maitlis for decrying Farage in this scandal.

Starkey is a Coutts customer. He said that the bank sent a letter to its customers saying that the bank ‘must not be brought into disrepute’ and said that the word ‘disrepute’ was used rather broadly there. He said he was surprised he hadn’t been cancelled. He is rather controversial on the conservative, traditional side of things.

He said that, when looking at the timeline of events, it was only when Farage threatened to go public that NatWest offered him an account with them to replace his Coutts accounts. Starkey then discussed Sir Howard Davies saying that he got the sack from the London School of Economics, which he headed, for giving Colonel Gaddafi’s son an unearned PhD in return for a sizeable donation from Gaddafi’s son’s foundation.

I mentioned this yesterday:

Alistair Osborne, one of The Times‘s business columnists, predicts ‘NatWest clearout looms after Farage fiasco’:

…

As for Davies, who’s on his way out anyway, his judgment has proved a throwback to the days when, as director of the London School of Economics, he accepted a £300,000 donation from a foundation run by Colonel Gaddafi’s son. The rest of the board — mainly a bunch of bankers, including Mark Seligman, ex of Credit Suisse, as the senior independent director — have also shown themselves incapable of governing a bank. Farage reckons they should all go. Again, he’s right. After this fiasco, a clearout looms.

Then Starkey told us that Davies was the first head of the Financial Conduct Authority (FCA)! Talk about failing upwards.

Both Starkey and Moylan emphasised how important client confidentiality was in banking. Moylan said that he worked for NatWest for a time 30 years ago. Staff received a regular employee bulletin. Under the social news of who got married was a list of people who were no longer employed by the bank. Moylan said that list of people either ‘had their hand in the till’ or broke confidentiality rules. Interesting.

Farage was up next. He was live in Bury that evening:

His editorial (5:43 mark) was about his lack of contact with Peter Flavel. At the 8:30 mark, he discussed Barclays’s call with shareholders that took place earlier that day and said that every question the shareholders asked was about de-banking.

Jacob Rees-Mogg’s State of the Nation followed:

I’ve posted the whole video because it’s excellent. In his editorial, he debunks the latest climate change report, then goes on to discuss climate change with his sister Annunziata and the founder of Labour’s radical wing, Momentum. Later on, he has a woman from PETA discussing Labour leader Sir Keir Starmer’s household rule that the Starmers’ children were not allowed fish or meat protein until they reached the age of 10. Rees-Mogg reminded his sister of how fond she was of processed ham as a youngster: ‘She could eat it by the hundredweight’.

The pertinent segment here is his discussion about ESG with businessman and ex-MEP Ben Habib:

Habib says that ESG runs everything and that the FCA have a prominent part to play in financial companies’ adherence because of reporting laws made in 2006 and 2008. That, incidentally, was when Tony Blair and Gordon Brown did their turns as Labour Prime Ministers. Habib says that financial corporation reports must include a section on how well the firms comply with ESG and how they will improve their adherence. He thinks the Government should change the law to relax the hold that ESG has on not only finance but other sectors of our society. He said that it should go by its other name, Diversity, Inclusion and Equity, because DIE is what is killing our social relationships. He said that he had been raised colour-blind — the way Martin Luther King advocated — but said that every aspect of DIE is advancing one group of people or policies over another.

On that note, NatWest is ‘purpose’-driven. Here is a screenshot I obtained which shows Dame Alison Rose championing ESG:

It is also a huge deal to qualify as a B Corp in the UK. They espouse ESG and DIE values and have given them the clever name of JEDI, the ‘J’ referring to ‘justice’, as in social justice.

Dan Wootton’s show came next. His editorial took issue with left-wing journalists and Labour politicians criticising Farage and saying that Dame Alison Rose’s dismissal was unfair, especially as she is a woman:

Unfortunately, GB News did not include the panel discussion afterwards. Conservative MP Dame Andrea Jenkyns said that she had had bank accounts closed. She has a damehood. What hope for the rest of us? She assumes this was because the bank deemed her to be a PEP, a politically exposed person. Someone else reminded her that she was a doughty supporter of Brexit, which might have been another factor.

Wootton interviewed Lord Frost:

The discussion about Farage only lasts the first couple of minutes. Frost is delighted that Farage and GB News are bringing this to light. The rest of the time is about how Frost has been labelled a climate change denier for saying that warmer temperatures would probably help Britain’s economy. They certainly would. Right now, it’s freezing. I’m sitting here in a long-sleeved shirt and a sweater.

Anyone wondering if Lord Frost will stand as an MP should know that he probably will. He tells Wootton that is where he can effect change. It’s a matter of not if but when. However, he quashes rumours that he wants to head the Conservative Party.

Headliners, which features comedians discussing the next day’s headlines, had a brief discussion on Emily Maitlis, who now has a podcast that airs on LBC. She said that Nigel Farage is trying to paint himself as the victim and is trying to ‘whip up a populist storm’. You can read more in a Telegraph article.

The Headliners headliners, even though they are left-leaning, took strong exception to Maitlis’s comments. Good for them:

On Friday morning, July 28, Breakfast discussed NatWest’s incredible profits over the past six months and Howard Davies’s questionable desire to remain as the banking group’s chair until his scheduled retirement in or around July 2024:

NatWest is 39% taxpayer-owned via the Government. We bailed it out after the 2008 banking crash.

Telegraph readers’ reactions

On Friday morning, The Telegraph published a selection of readers’ comments, ‘Nigel Farage de-bank, wildfires in Europe and “lazy girl” TikTok trends spark discussion’.

The first comment on Farage says:

Nigel Farage is right – the entire NatWest Board should go. They are responsible and accountable. That’s what being a senior director is. And now we need an investigation into all the banks, big and small, as this type of discrimination could well be embedded in the sector.

The second reads:

These top executives really don’t get it. Dame Alison Rose may well have achieved great things at the bank but her behaviour and that of the board reveals that such people are removed from the fundamental concerns of ordinary people – people who work just as hard, people who are just as capable, as Dame Alison but who are not remunerated with absurd salaries of £5.2 million.

Why they did not immediately understand that you cannot breach client confidentiality in the way she did as CEO and stay in post is an appalling indictment of their professional judgement. They are out of touch with the concerns and values of their customers; instead of listening to their marketing departments and pandering to the likes of Stonewall, they should get their hands dirty and go and work in a branch every once in a while.

The third says:

The so called highly ethical culture of banking which punishes the average man by closing accounts with no explanation or assistance is now truly exposed because NatWest took on a client too big to get away with their behaviour.

I am hoping this harsh treatment of Rose will give the banking sector the much needed shake up it needs for punishing the little man and forcing them out of the system effectively for minor mistakes made in everyday life.

This is a classic case of my enemies’ enemy is my friend, so Mr Farage hence has my full support and I am delighted to see a few senior banking heads roll.

Sir Howard Davies: sad but not sorry

On Friday morning dawned, The Telegraph reported on what NatWest’s chair had said to the media in a conference call. He spoke to shareholders afterwards:

Sir Howard Davies said he serves “at behest of shareholders” but intends to stay on despite the botched handling of the departure of chief executive Dame Alison Rose …

Asked if he has reflected on his position this week, Sir Howard said: “It would be surprising if I hadn’t reflected on my position. So the answer is yes.”

Sir Howard, a former deputy governor of the Bank of England is already preparing to step down by mid-2024 when he will have reached the maximum permitted length of his tenure as chairman – a role he assumed in 2015.

He was speaking as the bank revealed it increased pre-tax operating profit by nearly £1bn year-on-year to £3.6bn in the first six months of 2023.

The results were higher than forecast.

The Guardian‘s live coverage began earlier. Highlights follow, green bolds in the original:

At 6:49:

… NatWest is due to release its financial results at 7am. City analysts predict it will post an operating pretax profit of £1.49bn for the second quarter of 2023.

That would take earnings so far this year up to £3.3bn, up from £2.6bn in the same period last year.

NatWest, which has lost its CEO Alison Rose and the head of Coutts, Peter Flavel, in the last two days, may try to restore a sense of order as it updates investors about its performance …

At 7:20:

… NatWest has announced an interim dividend of 5.5p per share this morning, which will return around £492m to shareholders.

As the UK government owns 38.53% of NatWest, this means £190m will go to the government on 15th September.

Good.

At 8:18:

Speaking to reporters this morning, Davies says NatWest’s board met yesterday and agreed to the terms of reference for an independent review into the handling of Nigel Farage’s accounts at Coutts.

This review will examine the way in which information about that issue has been handled within the bank. The terms of reference of that review will be released today and the finding will be released “in due course”, says Davies.

He adds:

My intention is to continue to lead the board and ensure that the bank remains sound and stable and able to support our 19 million customers.

At 8:26:

Davies: political reaction forced “great leader” Alison Rose out

… He told reporters:

We took the view on Tuesday that even though mistakes had been made, it was on balance right to retain Alison Rose as our CEO.

But the reaction was such as to convince her and the board that her position was untenable.

Davies added that:

I clearly regret the way things have turned out. We’ve lost a great leader as a result, but I now have to look forward.

He was only sorry they got caught!

Also at 8:26:

When asked whether Farage’s accounts at Coutts had been reinstated, Howard Davies says it is “not appropriate for me to speak about the state of his accounts”.

At 8:39:

… Howard Davies says the bank always has an emergency plan ready for unexpected departure.

This plan was considered a few months ago, and NatWest decided Thwaite was the right person to be emergency successor.

This was discussed with Paul himself, Howard Davies says; Thwaite obviously wasn’t expecting this to happen, but was prepared to take the role on.

This position was also discussed with regulators, Davies adds, as they would expect a bank to have a succession plan in place.

At 8:43:

Davies says NatWest’s independent review into the closure of Nigel Farage’s Coutts account will have three dimensions.

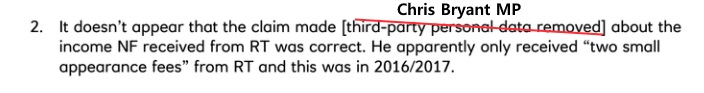

It will cover: the decision to close the accounts of Mr Farage; the circumstances around the BBC article (which initially said it was a commercial decision); and to review other Coutts account closures.

At 8:45:

And with regards to the Financial Conduct Authority’s involvement on the Farage bank account debacle, Howard Davies confirms the regulator have raised concerns with the bank.

With regard to account closures, these issues should be independently reviewed; we can certainly assure that will happen, Davies adds.

At 9:02:

NatWest is also asked about Alison Rose’s exit pay, following reports that she could receive a ‘multi-million-pound pay-off’.

Howard Davies says he can’t say precisely when details of the package will be published, explaining:

The independent review will take place and then we’ll have to consider it.

Davies adds that he doesn’t see a reason to depart from the normal practice of reporting executive pay.

He also explained, earlier in the call, that decisions on Rose’s pay can’t be made until the independent review has been completed.

At 9:19:

NatWest has appointed law firm Travers Smith to independently probe its handling of the Farage affair, our City editor Anna Isaac explains.

… One of its more sensitive tasks will be to put a spotlight on the circumstances and nature of any leaks to the press, and what confidential information may have been passed from the banking group to the media, including the BBC.

Beyond the handling of Farage’s accounts, the probe will also look at all accounts closed at Coutts over the past 24 months. It will follow a similar approach as with the Farage-specific investigation: looking at questions of how and why accounts were shut, and what was said to all other customers whose accounts were shut down.

And on a related topic, albeit with a different bank, this news emerged at 10:41:

Politicians on the right of the political spectrum aren’t the only ones to fall victim to ‘debanking’, it seems.

According to the BBC, anti-Brexit campaigner Gina Miller was told a bank account for her political party would close without explanation.

The BBC reports:

Monzo initially refused to tell Ms Miller why her “True and Fair” party account would be closed in September.

After the BBC contacted the bank about the case, it said it did not allow political party accounts and had made a mistake in allowing it to be opened.

Monzo said it recognised the experience would have been “frustrating for the customer and we’re sorry for that”.

More here.

At 13:12, we learned that the Bank of England is bringing in Ben Bernanke to review its dismal forecasting:

Newsflash: Dr Ben Bernanke, the former head of America’s central bank, the Federal Reserve, is to lead a review into the Bank of England’s forecasting.

The BoE says the review will aim to “develop and strengthen” the Bank’s support for the Monetary Policy Committee’s approach to forecasting and monetary policy making in times of uncertainty.

This follows criticism that the Bank failed to predict the surge in inflation over the last year or two, meaning it was too slow to tighten monetary policy by raising interest rates …

A month ago, the Bank’s chief economist, Huw Pill, said the Bank’s forecasting models became become “unworkable” in the current crisis, as they failed to fully appreciate the the interaction of high energy prices and a tight jobs market.

At 14:29:

Farage supports Gina Miller over bank account access

The row over access to UK bank accounts is creating some unlikely alliances.

Nigel Farage has thrown his backing behind anti-Brexit campaigner Gina Miller, after it emerged this morning that Monzo bank is to close the bank account of Miller’s True and Fair party.

Farage says he stands with Miller, who famously challenged the UK government in 2016 over its authority to trigger the process of leaving the European Union without parliamentary approval.

Miller warned this morning that “we don’t have a functioning democracy” if new political parties cannot access banking services.

At 14:53:

Nils Pratley: It will be surprising if NatWest’s Howard Davies hasn’t gone by Christmas

Can Howard Davies cling onto the top job on the NatWest board until 2024?

Our financial editor, Nils Pratley, thinks not – even though Davies himself hoped to hang on until July 2024, before the Farage bank row blew up.

Nils writes:

Davies has probably escaped the need for an instant resignation only by virtue of the fact that he was going anyway. Plan A, which pre-dates the Coutts fiasco, was for him to leave by July next year for the conventional reason that his nine-year term will be up at that point. An obvious strategy now would be to accelerate the timetable and get out as soon as is practical.

Since the search for a new chair has already been running for a few weeks, it should not take ages to find a new face, even if the pool of likely volunteers may have shrunk over the past week. One suspects Davies will want to be out in the autumn, or at least to have named his successor by then. And it will be amazing if he’s still there by Christmas. Under a new chair the necessary broader overhaul of the boardroom after the incompetence of the past month can begin.

I hope Nils Pratley is right. GB News has reported that Davies does not have the Prime Minister’s support.

At 15:09:

… NatWest cut its forecast for its net interest margin (the gap between what it charges borrowers and pays savers); a sign that some people have been running down their savings or moving them to more lucrative accounts …

Hmm.

Is this yet another case of ‘go woke, go broke’?

We shall see.

For now, I have one more banking post to come next week.

Yesterday, I wrote at length about Dame Alison Rose’s departure from the NatWest Group.

Opinions in print and on air continued into the evening and into Thursday morning, July 27, 2023.

Rose loses government appointments

Christian Calgie, a Guido Fawkes alumnus who now writes for The Express, told us ‘Humiliated Alison Rose sacked from two major Downing Street roles’ (purple emphases mine):

The now-former CEO of NatWest has suffered yet more career setbacks this morning, as the Government confirms she’s been ditched as a top advisor.

Dame Alison Rose had been appointed to an Energy Efficiency Taskforce within the Net Zero department in February and as a member of the PM’s Business Council just last week.

The Express understands she’s now been let go from both positions.

A No. 10 spokesperson said: “Following her resignation as CEO of NatWest Group, the Government has confirmed that Dame Alison Rose is no longer a member of the Prime Minister’s Business Council.”

Separately, a spokesperson for the Department for Net Zero has told the Express: “Following the news overnight, the Secretary of State has asked Dame Alison Rose to step down from her roles as co-chair of the Energy Efficiency Taskforce and as a Member of the Net Zero Council and she has resigned” …

Just last week she was also pictured laughing with Rishi Sunak at Downing Street, where she had been invited as part of the launch of Rishi Sunak’s new Business Council to help “turbocharge economic growth”.

At the time, Dame Alison said: “Partnership between government and business is the cornerstone of a sustainable growth economy.”.

“That’s why I’m delighted to be part of the Prime Minister’s Business Council for 2023. Working together we can face into the nation’s challenges to unlock investment, drive enterprise, grasp the opportunity of climate transition and ultimately, help UK economy to thrive.”

Dame Alison’s fate appeared sealed late last night after both Rishi Sunak, Jeremy Hunt and multiple Cabinet Ministers let it be known they had either lost faith in her continuing in the role or had serious concerns …

Political pressure forced the NatWest board, which had only hours before declared confidence in their CEO, to reconvene, leading to her resignation in the early hours.

The Government should encourage her to give up her damehood. She does not deserve it.

Early on Thursday, The Times reported that Rose could receive a whopping year’s salary. Sadly, this will surprise no one:

Dame Alison Rose’s departure from NatWest was under fresh scrutiny last night after it emerged she may be in line for a multimillion-pound payoff.

The 54-year-old chief executive left her position at the bank by “mutual consent” over the Nigel Farage debanking scandal. Her resignation was announced after a late-night board meeting, convened when Downing Street, the chancellor and other senior cabinet ministers put pressure on her to quit.

Analysts said the fact that Rose had agreed with the board to leave with immediate effect suggested she would receive pay in lieu of working notice. NatWest’s annual report indicates that the bank can make a payment in lieu of 12 months’ notice, signalling that she is in line to receive a year’s salary.

Rose’s pay package last year was £5.25 million, which included a £1.1 million base salary and the same amount again in shares, as well as an annual bonus and performance-related stock awards. NatWest had indicated that it would look to curb parts of Rose’s pay after she admitted leaking confidential information about Farage to the BBC.

NatWest declined to comment on her payoff, but sources said its stance remained the same, suggesting the bank would look to limit her remuneration.

Farage told The Times: “She should not be getting a payoff at all. She has breached the most basic rule of banking and brought the NatWest group into disrepute. It’s a reward for failure.”

My concerns are a) what will she do next and b) how soon will she take up another job? If I were a NatWest decision maker, I would put in writing that she cannot work for twelve months. If she does, she would have to return the payout they gave her. (Personally, I don’t think she should get anything, but the world doesn’t work the way it should.)

These were the final hours before her resignation early on Wednesday:

An hour-long virtual meeting between board members ended the 31-year NatWest career of Dame Alison Rose.

The hastily convened 10pm conference came less than five hours after Sir Howard Davies, the NatWest group chairman, had pledged the board’s “full support” to its beleaguered chief executive. But the members decided she had to go and released a statement, with words from both Davies and Rose, confirming the news at 1.29am …

The final blow was the revelation that Rishi Sunak, the prime minister, and Jeremy Hunt, the chancellor, had significant concerns about her remaining in her job. Behind the scenes there was a flurry of calls between senior government officials and the bank to relay a similar message.

Andrew Griffith, City minister, pressed on the late-night exchange of views, said: “There’s always a dialogue between typically Treasury officials and senior people in all of the big major banks. The prime minister and the chancellor have been clear throughout about the principle at stake here, which is that nobody should have their bank account removed as a result of something they’ve said or something that they believe in.”

When questioned over whether he had put in a call to NatWest, Griffith added: “I’m not going to comment on individual conversations that may have happened over the last 24 hours.” He said it was right that Rose had stepped down.

The political fallout from the earlier statement had prompted the NatWest board to reconvene. Then came the early morning U-turn confirmation.

The 1.29am statement said that Rose had agreed to step down by mutual consent and appointed Paul Thwaite, CEO of the bank’s commercial and institutional business, to take over.

[NatWest chairman Sir Howard] Davies, still defending his colleague, said: “It is a sad moment. She has dedicated all her working life so far to NatWest and will leave many colleagues who respect and admire her.”

More about him below.

On Wednesday, British banks were read the riot act by City Minister Andrew Griffith MP:

Leaders from Britain’s biggest banks admitted yesterday that the Farage debanking fiasco had tarnished the sector’s reputation with the public as they were hauled into a meeting with the City minister, Andrew Griffith. Griffith told banking chiefs, including those from NatWest, HSBC, Lloyds, Barclays and Nationwide, that the idea a customer could be debanked over their views was “wholly unacceptable”.

Also:

The Information Commissioner’s Office has announced an investigation into whether any rules were broken. NatWest shares fell 3.7 per cent yesterday.

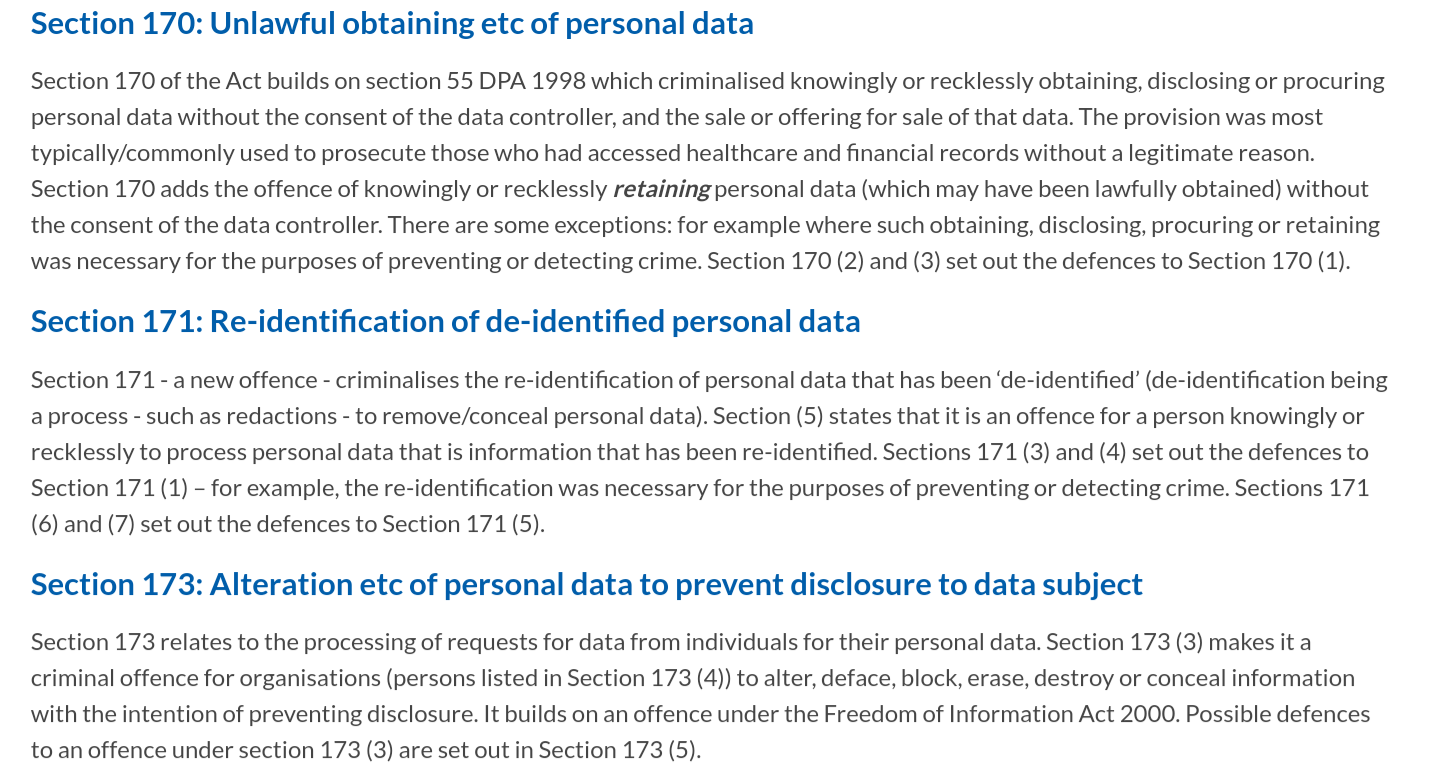

The Telegraph had more on the Information Commissioner’s Office in ‘NatWest may have broken the law over Farage Coutts scandal’:

On Wednesday, senior Conservative MPs demanded that Dame Alison forgo any severance pay. The bank declined to say whether she will receive an exit package.

John Edwards, the information commissioner, said on Wednesday: “The banking duty of confidentiality is over a hundred years old, and it is clear that it would not permit the discussion of a customer’s personal information with the media.

“We trust banks with our money and with our personal information. Any suggestion that this trust has been betrayed will be concerning for a bank’s customers, and for regulators like myself.”

The ICO said that if the bank could not resolve a complaint made by Mr Farage, it would begin its own inquiries.

Mr Edwards warned banks against holding excessive information on their customers after The Telegraph revealed NatWest had accumulated a 40-page dossier on Mr Farage to feed back to its Wealth Reputational Risk Committee. That dossier could be in breach of data protection rules …

The ICO can bring criminal prosecutions, although it is more likely that NatWest would face a civil penalty, sources said.

It can issue fines of up to four per cent of a company’s worldwide turnover, which in the case of NatWest could run into hundreds of millions of pounds.

GB News reaction

Nigel Farage devoted the bulk of his show to Wednesday’s developments:

While Farage was happy that Rose resigned, he said in his editorial that Sir Howard Davies and the board of directors should also stand down. He also said that he would be developing a website dedicated to people who have had their bank accounts closed for no good reason. Former Chancellor Kwasi Kwarteng was Farage’s first guest. Kwarteng said that banks’ targeting of individuals and closing their accounts is something new and he was not aware of it until recently, especially with small businesses. He was grateful that Farage is shining a light on this parlous business practice. Conservative MP Royston Smith was the next guest. He said that TSB had closed his account a year ago for no apparent reason then had the affrontery to send him a cheque for the balance. He had nowhere to cash it, so he tried to contact the bank to no avail. It was only when he tweeted recently about his situation that TSB finally contacted him. The situation is still unresolved.

Afterwards came a vox pop. GB News had interviewed people working in the City of London, the financial centre. The verdict was about 50/50 on Rose’s resignation. Some, including a lot of Europeans, said that it was an overreaction. Britons, however, by and large, said it was the right thing to do. Labour MP Lloyd Russell-Moyle, not a natural fit with Farage, appeared next. His name has not helped people with whom he has been associated. A charity reluctantly told him he could not be associated with them because he is too controversial, or so their bank thought, and his lodgers (renters) have had the same experience with their banks, one of which was Santander. He will support Farage’s quest to stop this happening.

Countess Alexandra Tolstoy came on next. I discussed her case in my July 12 post, and she related much the same to Farage. Here again, NatWest was the culprit. The Times featured her story today, Thursday, July 27. Farage’s last segment concerned the mysterious case of a bank branch in Reading, Berkshire, found guilty of mishandling loans to medium-sized businesses. The bank in question, HBOS owned by Lloyds, agreed to lend them money. Once a company had spent the money, the bank would call in the loan, forcing the company to go bankrupt. The bank then got the assets of that company and made millions. This happened during David Cameron’s and Theresa May’s premierships. A cabinet secretary said he would look into it and then said he had been advised not to talk to former Thames Valley Police and Crime Commissioner Anthony Stansfeld who had raised the issue with him. Stansfeld told Farage this scam was well into the hundreds of millions of pounds. The Prime Ministers did not want to know. The network also involved other banks in other cities, but their police forces ignored the story. Stansfeld said it took three years to solve the case, held before a jury, and put things to right thanks to the chief constable. It seems part of this investigation is still ongoing in Bristol, where Lloyds says it is still investigating, but, for now, denies any wrongdoing.

Jacob Rees-Mogg was next:

The discussion about Farage’s bank account started at the 20:21 mark. Rees-Mogg said that taxpayers lost £325m that day on Rose’s resignation. A former Coutts employee, Oliver Lewis was a guest. He had left the bank to write a biography of George Orwell, oddly enough. Lewis left in 2015 when Rose was appointed the head of wealth management. He was amazed to find out that all this had happened, because she was so professional and diplomatic.

Toby Young of the Free Speech Union took issue with the Financial Conduct Authority (FCA) complaining about the Government urging Rose’s resignation. This is because Farage had no due process; Coutts’s decision, Young said, was overridden by ideology. Oliver Lewis said that he used to write meeting minutes but never would have written Farage’s report in such a brusque way with so many accusations. Conversation then turned to Brexit Derangement Syndrome — Rees-Mogg’s words — about Nigel and Boris Johnson. Toby Young said that unwarrented bank account closures could happen to anyone. He praised Keir Starmer for finally condemning Coutts’s conduct in this affair. Rees-Mogg wondered what would happen if former Labour leader Jeremy Corbyn had been debanked.

All hoped that banking would return to normal soon. Lewis said that banking at NatWest is not 100% commercial because of the government bailout after the 2008 banking crisis — the taxpayer still owns 39% of the banking group — but also because government basically guarantees banking rights, at least in principle.

Dan Wootton devoted two segments to the Farage farrago.

In his editorial, he said it is important that people continue to speak up about it, otherwise we will be walking into enforced personal silence and control. He said that the criticisms of GB News are actually criticisms of the majority of the British people. Like Trump was for many Americans, GB News was ‘only in the way’. The people are the target:

Wootton also spoke with The Telegraph‘s Celia Walden — Mrs Piers Morgan — who finds the situation appalling. She thinks our banks’ social policy practices came over from the United States:

On Thursday morning, Spiked‘s Fraser Myers told the channel’s Breakfast show that Coutts probably thought it was doing its notional duty by closing Farage’s account, which, he said, was ‘a scary thing’:

What this mean for the future of ESG?

On Thursday, The Times posted ‘What does the Farage v Coutts row mean for ESG?’

Opinions in the legal world are divided, but law firms and other businesses have been moving towards ESG in recent years:

For some commentators it was only a matter of time that unbridled enthusiasm for the creation of standards for ethical corporate behaviour backfired. Even at the end of 2021 litigation was emerging around ESG that involved arguments over the boundaries of liability.

Nonetheless, the ESG bandwagon has continued to collect passengers, including many prominent law firms. In February the Anglo-US law firm DLA Piper was placed top of an inaugural ESG league table for the legal profession compiled by Impactvise, a consultancy that specialises in corporate ethics. The consultancy, which is based in Switzerland, was founded by two lawyers: Yannick Hausmann and Adrian Peyer, both of whom had worked at Zurich Insurance.

Impactvise certainly talks the ESG talk, saying that “legal service providers — particularly, lawyers at law firms and in-house corporate counsels — are key players in the modern value chain, and have a unique position to support the move towards a sustainable future”. But with rumblings that Farage could take legal action against Coutts over its approach to him and his account, many law firms may be having second thoughts about how closely they want to stand next to their clients’ ESG schemes, or indeed whether they should have their own.

Jean-Pierre Douglas-Henry, the managing director of sustainability and resilience at DLA Piper, acknowledges the conundrum. He says: “Businesses are increasingly being asked by policymakers to be aware of the impact of sustainability issues such as climate change and biodiversity loss.

“In some countries businesses are being required by law to factor these risks into their operations at every level, while in others they are just waking up to the risks involved.”

Others argue that it is wrong to label Farage’s row with Coutts as having its roots in the ESG movement. “The issue in the Farage case is that a risk-based decision about a politically exposed person had nothing at all to do with ESG and corporate values . . . and yet Coutts appears to have conflated the two things,” says Michael Evans, a former head of communications at Baker McKenzie in London and now a director at Byfield, a litigation and reputation consultancy.

Evans argues that Coutts’s risk committee was “very selective in identifying Farage as posing a reputational risk to the bank and its inclusive values when you look at some of its other current and former clients. In dropping Farage as a client, this was an example of virtue signalling gone too far by Coutts” …

The Coutts case is also interesting because of Farage’s use of a subject access request under freedom of information law to get a report from Coutts’s reputational risk committee used to justify the closure. Tony Williams, a former Clifford Chance managing partner who is now the director of the legal profession consultancy Jomati, says that the use of that facility represents a “ticking time bomb that many organisations may have if they prepare profiles of their customers”.

Williams speculates that law firms “will become rather more circumspect as to certain clients they act for, but inevitably will make some commercial decisions and recognise the reality that if every client was perfect they probably wouldn’t need lawyers very much”.

As to whether the Farage-Coutts saga will hole ESG below the waterline, Evans is doubtful. “That is not to say the anti-ESG backlash isn’t real, but the legal sector’s view to date has very much been that a firm must have its own house in order so that they can be taken seriously by big corporate clients grappling with ESG-related issues,” he says. “This view seems unlikely to change any time soon.”

Ben Marlow, The Telegraph‘s chief City commentator, says ‘The NatWest debacle exposes the bone-headedness of corporate moralising’:

There needs to be a thorough rethink of the bank’s pious posing and how its devotion to the corporate “purpose” movement led it to make such a series of terrible decisions.

The bone-headedness of corporate moralising is as much to blame for this debacle as the poor judgement of senior executives. Indeed, it is hard to imagine that the bank would ever have picked a fight with the former UKIP leader in the first place if it hadn’t well and truly disappeared down a rabbit hole of hypocrisy.

This is an organisation that harps on endlessly about diversity and inclusion, yet went to great lengths to come up with reasons to dissolve its relationship with one person on the basis that his personal views didn’t fit with their interpretation of the world. What could be less inclusive than that?

As Farage correctly points out, the problem with so much of the Ethical, Social and Governance (ESG) fanaticism that companies have been captured by is that our values and the politics that underpin them are, erm, diverse.

And because ESG is essentially an ideological leap of faith, its most committed proponents struggle to accept anyone challenging their stance.

The experience of Reverend Richard Fothergill is no less troubling than Farage’s. The clergyman was allegedly de-banked by Yorkshire Building Society after 17 years as an account holder for asking its customer services department whether promotion of LGBT causes was a good use of its time …

Banks have turned contempt into an art form and suspicions of profiteering during a cost of living crunch are hard to avoid. Customers want rip-off charges to end, and fairer savings rates, particularly when they’ve suddenly found themselves on a mortgage that is no longer even remotely affordable …

If NatWest is to recover quickly from this damaging episode it needs to abandon the moral crusade and rediscover – yet again – the old-fashioned and boring business of being a bank.

On Thursday morning, The Telegraph reported that NatWest and Barclays received the most complaints about account closures:

NatWest was the subject of the joint most complaints over decisions to close bank accounts last year, data show, a day after its boss resigned following a scandal over the closure of Nigel Farage’s Coutts account.

Customers complained about NatWest and rival Barclays 274 times each in 2022/23, figures supplied to Bloomberg showed. This includes cases linked to NatWest’s Royal Bank of Scotland brand.

The data from the Financial Ombudsman Service, the independent body that settles issues between customers and lenders, show NatWest was the most complained-about bank for the past three years in terms of account closures, although the absolute number for all the lenders is a fraction of the millions of accounts they each service.

It comes after Dame Alison Rose resigned on Wednesday after discussing Mr Farage’s account with a BBC journalist, wiping £850m off the value of the lender.

Should the NatWest board go?

It isn’t just Nigel Farage saying that Sir Howard Davies and NatWest’s board of directors should go.

On Thursday, The Times posted ‘Investor’s ire at “appalling” bank board’:

In a blistering broadside, Martin Walker, head of UK equities at Invesco, a NatWest shareholder, said, “there is clearly a problem in this business with governance.

“Frankly, I am appalled at both management and board behaviour in this whole episode. NatWest is a good business that has many strengths and when the governance isn’t robust within a business, then those strengths will never be reflected in the share price.”

Walker’s intervention increases the pressure on Sir Howard Davies, the bank’s chairman, who already faces scrutiny over the chaotic departure of Rose, the lender’s chief executive …

“Her role was clearly untenable,” Walker said. “You have to call into question the judgment of the board here” …

Walker said the Farage affair raised concerns beyond Rose’s departure. Invesco owns a stake in NatWest worth about £128 million, a portion of which is managed by Walker.

Davies, apparently, was already scheduled to leave NatWest:

A source at the bank insisted that Davies, who was already due to step down by the middle of next year, had “absolutely engaged” with the government. NatWest shares fell by 9½p, or 3.7 per cent, to close at 241¾p yesterday as investors digested the developments.